Safeway 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAFEWAY INC. AND SUBSIDIARIES

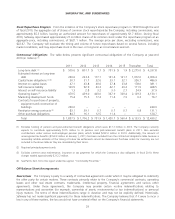

Workers’ Compensation The Company is primarily self-insured for workers’ compensation, automobile and general

liability costs. It is the Company’s policy to record its self-insurance liability as determined actuarially, based on claims filed

and an estimate of claims incurred but not yet reported.

Self-insurance reserves are actuarially determined primarily by applying historical paid loss and incurred loss development

trends to current cash and incurred expected losses in order to estimate total losses. We then discount total expected

losses to their present value using a risk free rate of return.

Any actuarial projection of self-insured losses is subject to a high degree of variability. For example, self-insurance expense

was $148.3 million in fiscal 2010, $128.8 million in fiscal 2009 and $161.6 million in 2008. Litigation trends, legal

interpretations, benefit level changes, claim settlement patterns and similar factors influenced historical development

trends that were used to determine the current year expense and therefore contributed to the variability in annual

expense. However, these factors are not direct inputs into the actuarial projection, and thus their individual impact cannot

be quantified.

The discount rate is a significant factor that has led to variability in self-insured expenses. Since the discount rate is a

direct input into the estimation process, we are able to quantify its impact. The discount rate, which is based on the

United States Treasury Note rates for the estimated average claim life of five years, was 2.0% in 2010, 2.75% in 2009

and 1.75% in 2008. A 25-basis-point change in the discount rate affects the self-insured liability by approximately $4.3

million.

The majority of the Company’s workers’ compensation liability is from claims occurring in California. California workers’

compensation has received intense scrutiny from the state’s politicians, insurers, employers and providers, as well as the

public in general. Recent years have seen escalation in the number of legislative reforms, judicial rulings and social

phenomena affecting this business. Some of the many sources of uncertainty in the Company’s reserve estimates include

changes in benefit levels, medical fee schedules, medical utilization guidelines, vocation rehabilitation and apportionment.

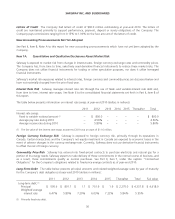

Store Lease Exit Costs and Impairment Charges Safeway’s policy is to recognize losses relating to the impairment of

long-lived assets when expected net future cash flows are less than the assets’ carrying values. When stores that are

under long-term leases close, Safeway records a liability for the future minimum lease payments and related ancillary

costs, net of estimated cost recoveries. In both cases, fair value is determined by estimating net future cash flows and

discounting them using a risk-adjusted rate of interest. The Company estimates future cash flows based on its experience

and knowledge of the market in which the closed store is located and, when necessary, uses real estate brokers.

However, these estimates project future cash flows several years into the future and are affected by factors such as

inflation, real estate markets and economic conditions.

At any one time, Safeway has a portfolio of closed stores which is widely dispersed over several markets. While individual

closed store reserves are likely to be adjusted up or down in the future to reflect changes in assumptions, the change to

the total closed store reserve has not been nor is expected to be material.

Employee Benefit Plans The Company recognizes in its balance sheet a liability for the underfunded status of its

employee benefit plans. The Company measures plan assets and obligations that determine the funded status as of fiscal

year end. Additional disclosures are provided in Note K to the consolidated financial statements, set forth in Part II, Item 8

of this report.

The determination of Safeway’s obligation and expense for pension benefits is dependent, in part, on the Company’s

selection of certain assumptions used by its actuaries in calculating these amounts. These assumptions are disclosed in

Note K to the consolidated financial statements and include, among other things, the discount rate, the expected long-

term rate of return on plan assets and the rate of compensation increases. Actual results in any given year will often differ

from actuarial assumptions because of economic and other factors. In accordance with generally accepted accounting

principles (“GAAP”), the amount by which actual results differ from the actuarial assumptions is accumulated and

amortized over future periods and, therefore, affects recognized expense in such future periods. While Safeway believes

23