Safeway 2010 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2010 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

PART II

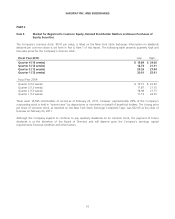

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities

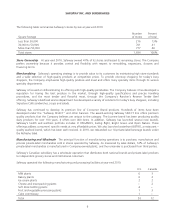

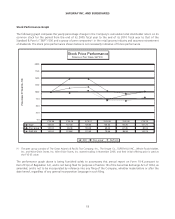

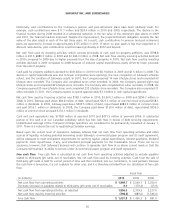

The Company’s common stock, $0.01 par value, is listed on the New York Stock Exchange. Information on dividends

declared per common share is set forth in Part II, Item 7 of this report. The following table presents quarterly high and

low sales prices for the Company’s common stock.

Fiscal Year 2010: Low High

Quarter 4 (16 weeks) $ 19.89 $ 24.00

Quarter 3 (12 weeks) 18.73 21.91

Quarter 2 (12 weeks) 20.53 27.04

Quarter 1 (12 weeks) 20.91 25.41

Fiscal Year 2009:

Quarter 4 (16 weeks) $ 19.15 $ 23.63

Quarter 3 (12 weeks) 17.87 21.15

Quarter 2 (12 weeks) 18.98 21.73

Quarter 1 (12 weeks) 17.19 24.25

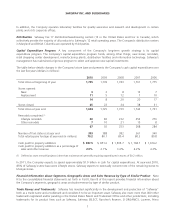

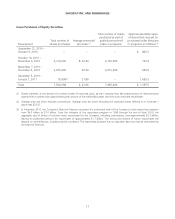

There were 14,595 stockholders of record as of February 23, 2011; however, approximately 99% of the Company’s

outstanding stock is held in “street name” by depositories or nominees on behalf of beneficial holders. The closing price

per share of common stock, as reported on the New York Stock Exchange Composite Tape, was $22.05 at the close of

business on February 23, 2011.

Although the Company expects to continue to pay quarterly dividends on its common stock, the payment of future

dividends is at the discretion of the Board of Directors and will depend upon the Company’s earnings, capital

requirements, financial condition and other factors.

16