Safeway 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

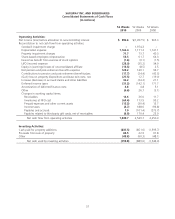

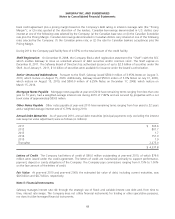

Cost of Goods Sold Cost of goods sold includes cost of inventory sold during the period, including purchase and

distribution costs. These costs include inbound freight charges, purchasing and receiving costs, warehouse inspection

costs, warehousing costs and other costs of Safeway’s distribution network. Advertising and promotional expenses are

also included as a component of cost of goods sold. Such costs are expensed in the period the advertisement occurs.

Advertising and promotional expenses totaled $508.7 million in 2010, $502.9 million in 2009 and $492.1 million in 2008.

Vendor allowances totaled $2.9 billion in 2010 and $2.6 billion in both 2009 and 2008. Vendor allowances can be

grouped into the following broad categories: promotional allowances, slotting allowances and contract allowances. All

vendor allowances are classified as an element of cost of goods sold.

Promotional allowances make up approximately 90% of all allowances. With promotional allowances, vendors pay

Safeway to promote their product. The promotion may be any combination of a temporary price reduction, a feature in

print ads, a feature in a Safeway circular or a preferred location in the store. The promotions are typically one to two

weeks long.

Slotting allowances are a small portion of total allowances (approximately 5% of all allowances). With slotting

allowances, the vendor reimburses Safeway for the cost of placing new product on the shelf. Safeway has no obligation

or commitment to keep the product on the shelf for a minimum period.

Contract allowances make up the remainder of all allowances. Under a typical contract allowance, a vendor pays Safeway

to keep product on the shelf for a minimum period of time or when volume thresholds are achieved.

Promotional and slotting allowances are accounted for as a reduction in the cost of purchased inventory and recognized

when the related inventory is sold. Contract allowances are recognized as a reduction in the cost of goods sold as volume

thresholds are achieved or through the passage of time.

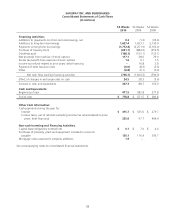

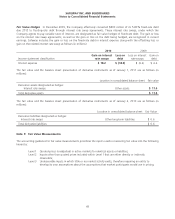

Cash and Equivalents Cash and equivalents include short-term investments with original maturities of less than three

months and credit and debit card sales transactions which settle within a few business days of year end.

Book overdrafts at year-end 2010 and 2009 of $90.1 million and $160.4 million, respectively, are included in accounts

payable.

Receivables Receivables include pharmacy, gift card receivables and miscellaneous trade receivables.

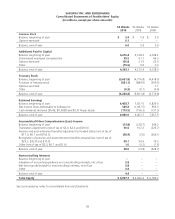

Merchandise Inventories Merchandise inventory of $1,685 million at year-end 2010 and $1,629 million at year-end

2009 is valued at the lower of cost on a last-in, first-out (“LIFO”) basis or market value. Such LIFO inventory had a

replacement or current cost of $1,720 million at year-end 2010 and $1,692 million at year-end 2009. Liquidations of LIFO

layers during the three years reported did not have a material effect on the results of operations. All remaining inventory

is valued at the lower of cost on a first-in, first-out (“FIFO”) basis or market value. The FIFO cost of inventory

approximates replacement or current cost. The Company performs physical counts of perishable inventory in stores every

four weeks and nonperishable inventory in stores and all distribution centers twice a year. The Company uses a

combination of the retail inventory method and cost method to determine the cost of its inventory before any LIFO

reserve is applied. The Company records an inventory shrink adjustment upon physical counts and also provides for

estimated inventory shrink adjustments for the period between the last physical inventory and each balance sheet date.

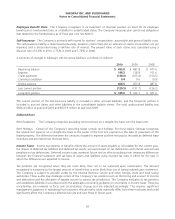

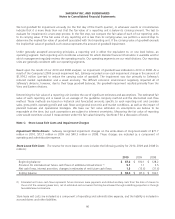

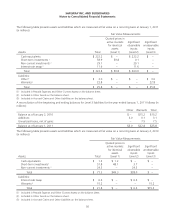

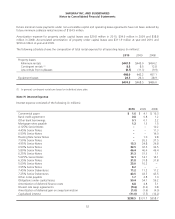

Property and Depreciation Property is stated at cost. Depreciation expense on buildings and equipment is computed

on the straight-line method using the following lives:

Stores and other buildings 7 to 40 years

Fixtures and equipment 3 to 15 years

Property under capital leases and leasehold improvements are amortized on a straight-line basis over the shorter of the

remaining terms of the leases or the estimated useful lives of the assets.

42