Safeway 2010 Annual Report Download - page 57

Download and view the complete annual report

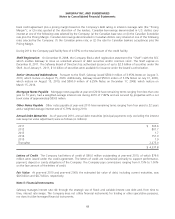

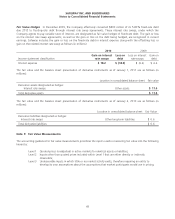

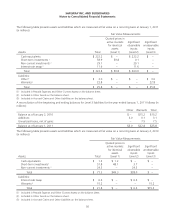

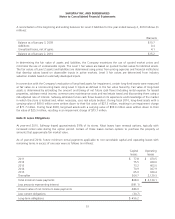

Please find page 57 of the 2010 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

Note A: The Company and Significant Accounting Policies

The Company Safeway Inc. (“Safeway” or the “Company”) is one of the largest food and drug retailers in North

America, with 1,694 stores as of year-end 2010. Safeway’s U.S. retail operations are located principally in California,

Oregon, Washington, Alaska, Colorado, Arizona, Texas, the Chicago metropolitan area and the Mid-Atlantic region. The

Company’s Canadian retail operations are located principally in British Columbia, Alberta and Manitoba/Saskatchewan. In

support of its retail operations, the Company has an extensive network of distribution, manufacturing and food

processing facilities. The Company also owns and operates GroceryWorks.com Operating Company, LLC, an online

grocery channel, doing business under the names Safeway.com, Vons.com and Genuardis.com (collectively

“Safeway.com”).

Blackhawk Network, Inc. (“Blackhawk”), a majority-owned subsidiary of Safeway, provides third-party gift cards, prepaid

cards, telecom cards, and sports and entertainment cards through leading grocery, convenience and other retailers in

North America, Europe and Asia.

The Company also has a 49% ownership interest in Casa Ley, S.A. de C.V. (“Casa Ley”), which operates 168 food and

general merchandise stores in Western Mexico.

Basis of Presentation The consolidated financial statements include Safeway Inc., a Delaware corporation, and all

majority-owned subsidiaries and have been prepared in accordance with accounting principles generally accepted in the

United States of America. All intercompany transactions and balances have been eliminated in consolidation. The

Company’s investment in Casa Ley is reported using the equity method and is recorded on a one-month delay basis

because financial information for the latest month is not available from Casa Ley in time to be included in Safeway’s

consolidated results until the following reporting period.

Fiscal Year The Company’s fiscal year ends on the Saturday nearest December 31. The last three fiscal years consist of

the 52-week period ended January 1, 2011 (“fiscal 2010” or “2010”), the 52-week period ended January 2, 2010 (“fiscal

2009” or “2009”) and the 53-week period ended January 3, 2009 (“fiscal 2008” or “2008”).

Use of Estimates The preparation of financial statements, in conformity with accounting principles generally accepted

in the United States of America, requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements,

and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those

estimates.

Translation of Foreign Currencies Assets and liabilities of the Company’s Canadian subsidiaries and Casa Ley are

translated into U.S. dollars at year-end rates of exchange, and income and expenses are translated at average rates during

the year. Adjustments resulting from translating financial statements into U.S. dollars are reported, net of applicable

income taxes, as a separate component of comprehensive income in the consolidated statements of stockholders’ equity.

Revenue Recognition Retail store sales are recognized at the point of sale. Sales tax is excluded from revenue. Internet

sales are recognized when the merchandise is delivered to the customer. Discounts provided to customers in connection

with loyalty cards are accounted for as a reduction of sales.

Safeway records a deferred revenue liability when it sells Safeway gift cards. Safeway records a sale when a customer

redeems the gift card. Safeway gift cards do not expire. The Company reduces the liability and increases other revenue

for the unused portion of gift cards (“breakage”) after two years, the period at which redemption is considered remote.

Breakage amounts were $9.2 million, $8.7 million and $7.9 million in 2010, 2009 and 2008, respectively.

The Company, through its Blackhawk subsidiary, also sells third-party gift cards through Safeway retail operations and

through other grocery and convenience store retailers. Safeway earns a commission which is recorded as other revenue

when the third-party gift card is sold to the end consumer. The liability for redemption and potential income for breakage

remains with the third-party merchant; therefore, Safeway does not record redemption or breakage of these gift cards.

41