Safeway 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

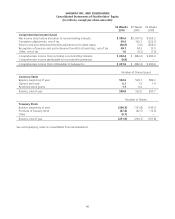

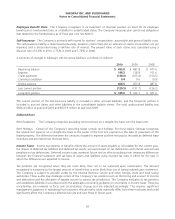

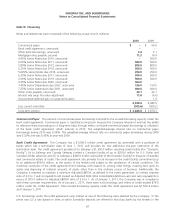

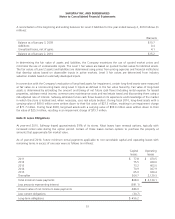

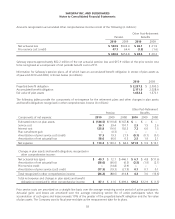

Fair Value Hedges In December 2009, the Company effectively converted $800 million of its 5.80% fixed-rate debt

due 2012 to floating-rate debt through interest rate swap agreements. These interest rate swaps, under which the

Company agrees to pay variable rates of interest, are designated as fair value hedges of fixed-rate debt. The gain or loss

on the interest rate swap agreements, as well as the gain or loss on the debt being hedged, are recognized in current

earnings. Safeway includes the gain or loss on the fixed-rate debt in interest expense along with the offsetting loss or

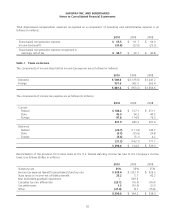

gain on the related interest rate swap as follows (in millions):

2010 2009

Income statement classification

Gain on interest

rate swaps

Loss on

debt

Loss on interest

rate swaps

Gain on

debt

Interest expense $ 18.2 $ (18.2) $ (6.6) $ 6.6

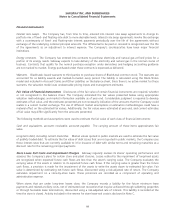

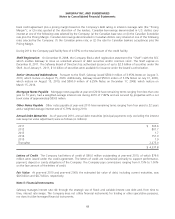

The fair value and the balance sheet presentation of derivative instruments as of January 1, 2011 are as follows (in

millions):

Location in consolidated balance sheet Fair value

Derivative assets designated as hedges:

Interest rate swaps Other assets $ 11.6

Total derivative assets $ 11.6

The fair value and the balance sheet presentation of derivative instruments as of January 2, 2010 are as follows (in

millions):

Location in consolidated balance sheet Fair Value

Derivative liabilities designated as hedges:

Interest rate swaps Other long-term liabilities $ 6.6

Total derivative liabilities $ 6.6

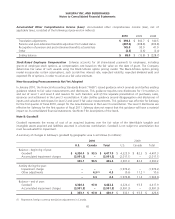

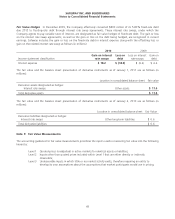

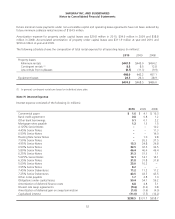

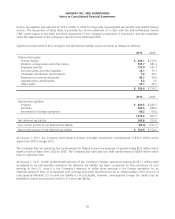

Note F: Fair Value Measurements

The accounting guidance for fair value measurements prioritizes the inputs used in measuring fair value into the following

hierarchy:

Level 1 Quoted prices (unadjusted) in active markets for identical assets or liabilities;

Level 2 Inputs other than quoted prices included within Level 1 that are either directly or indirectly

observable;

Level 3 Unobservable inputs in which little or no market activity exists, therefore requiring an entity to

develop its own assumptions about the assumptions that market participants would use in pricing.

49