Safeway 2010 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2010 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAFEWAY INC. AND SUBSIDIARIES

evaluate for impairment is a two-step process. In the first step, we compare the fair value of each of our reporting units

to its carrying value. If the fair value of any reporting unit is less than its carrying value, we perform a second step to

determine the implied fair value of goodwill associated with that reporting unit. If the carrying value of goodwill exceeds

the implied fair value of goodwill, such excess represents the amount of goodwill impairment.

Under generally accepted accounting principles, a reporting unit is either the equivalent to, or one level below, an

operating segment. Each reporting unit constitutes a business for which discrete financial information is available and for

which segment management regularly reviews the operating results. Our operating segments are our retail divisions. Our

reporting units are generally consistent with our operating segments.

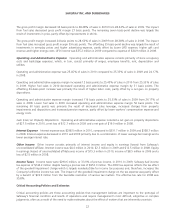

As a result of the Company’s annual impairment test, Safeway recorded a non-cash impairment charge in the amount of

$1,974.2 million (pre-tax) in 2009 to reduce the carrying value of goodwill. The impairment was due primarily to

Safeway’s reduced market capitalization and a weak economy. The difficult economic environment negatively impacted

all of Safeway’s divisions; however, due to their large goodwill balances, the goodwill impairment resulted primarily from

the Vons and Eastern divisions. Based upon the results of our analysis, no impairment of goodwill was indicated in 2010

or 2008.

Determining the fair value of a reporting unit involves the use of significant estimates and assumptions. The estimated fair

value of each reporting unit is based on an average of the guideline company method and the discounted cash flow

method. These methods are based on historical and forecasted amounts specific to each reporting unit and consider,

sales, gross profit, operating profit and cash flows and general economic and market conditions, as well as the impact of

planned business and operational strategies. We base our fair value estimates on assumptions we believe to be

reasonable at the time, but such assumptions are subject to inherent uncertainty.

Actual results may be substantially different than the results forecasted in our estimate of a reporting unit’s fair value,

resulting in additional goodwill impairment in the future. Additionally, the aggregate fair value of all the reporting units is

reconciled to Safeway’s total market capitalization. Therefore, a significant and sustained decline in our stock price could

also result in additional impairment charges. However, the majority of the remaining $430.9 million of goodwill is at

reporting units that have estimated fair value that is at least 50% greater than book value. Reporting units, whose fair

value exceeds book value by less than 50%, have total goodwill of $106 million.

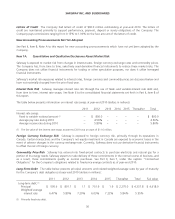

Income Tax Contingencies The Company is subject to periodic audits by the Internal Revenue Service and other

foreign, state and local taxing authorities. These audits may challenge certain of the Company’s tax positions such as the

timing and amount of income and deductions and the allocation of taxable income to various tax jurisdictions. The

Company evaluates its tax positions and establishes liabilities in accordance with the applicable accounting guidance on

uncertainty in income taxes. These tax uncertainties are reviewed as facts and circumstances change and are adjusted

accordingly. This requires significant management judgment in estimating final outcomes. Actual results could materially

differ from these estimates and could significantly affect the Company’s effective tax rate and cash flows in future

years. Note J to the consolidated financial statements set forth in Part II, Item 8 of this report provides additional

information on income taxes.

Liquidity and Financial Resources

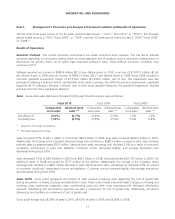

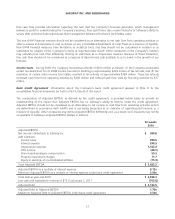

Net cash flow from operating activities was $1,849.7 million in 2010, $2,549.7 million in 2009 and $2,250.9 million in

2008. Net cash flow from operating activities declined in 2010 compared to 2009 primarily because of lower net income

in 2010 compared to net income excluding goodwill impairment charge in 2009 and cash flow used by working capital

items in 2010.

Blackhawk receives a significant portion of the cash inflow from the sale of third-party gift cards late in the fourth quarter

of the year and remits the majority of the cash, less commissions, to the card partners early in the first quarter of the

following year. Cash flow from gift-card sales declined from $170.4 million in 2009 to a use of cash of $6.9 million in

2010, primarily as a result of the timing of certain vendor payments in 2009 and to the change in the timing of holiday

sales compared to fiscal year end.

25