Safeway 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

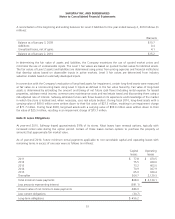

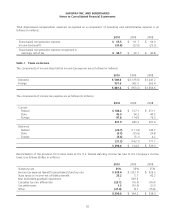

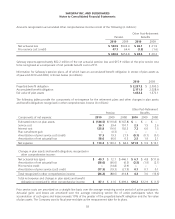

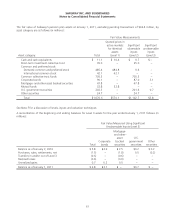

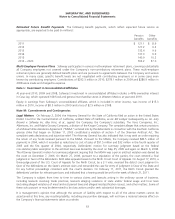

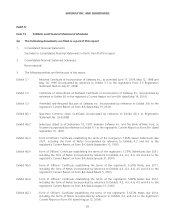

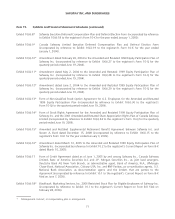

The fair value of Safeway’s pension plan assets at January 1, 2011, excluding pending transactions of $24.4 million, by

asset category are as follows (in millions):

Fair Value Measurements

Asset category: Total

Quoted prices in

active markets

for identical

assets

(Level 1)

Significant

observable

inputs

(Level 2)

Significant

unobservable

inputs

(Level 3)

Cash and cash equivalents $ 11.1 $ 10.4 $ 0.7 $ –

Short-term investment collective trust 35.0 – 35.0 –

Common and preferred stock:

Domestic common and preferred stock 485.4 484.8 0.6 –

International common stock 42.1 42.1 – –

Common collective trust funds 705.3 – 705.3 –

Corporate bonds 90.1 – 87.0 3.1

Mortgage- and other-asset backed securities 47.8 – 47.8 –

Mutual funds 32.8 32.8 – –

U.S. government securities 202.3 – 201.6 0.7

Other securities 24.7 – 24.7 –

Total $1,676.6 $570.1 $1,102.7 $3.8

See Note F for a discussion of levels, inputs and valuation techniques.

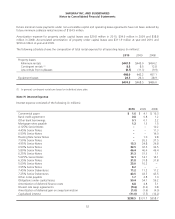

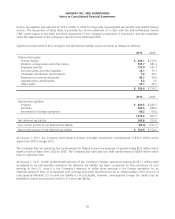

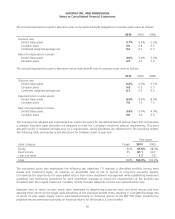

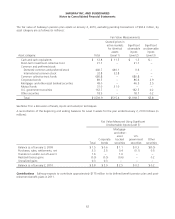

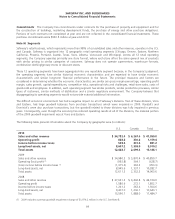

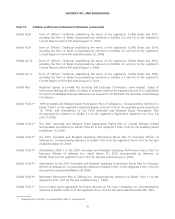

A reconciliation of the beginning and ending balances for Level 3 assets for the year ended January 1, 2011 follows (in

millions):

Fair Value Measured Using Significant

Unobservable Inputs (Level 3)

Total

Corporate

bonds

Mortgage-

and other-

asset

backed

securities

U.S.

government

securities

Other

securities

Balance as of January 2, 2010 $ 5.8 $2.9 $ 2.5 $0.2 $ 0.2

Purchases, sales, settlements, net (1.5) – (1.8) 0.5 (0.2)

Transfers in and/or out of Level 3 (0.6) – (0.6) – –

Realized losses (0.6) – (0.6) – –

Unrealized gains 0.7 0.2 0.5 – –

Balance as of January 1, 2011 $ 3.8 $3.1 $ – $0.7 $ –

61