Safeway 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAFEWAY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

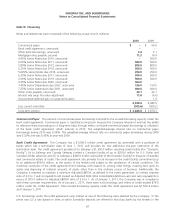

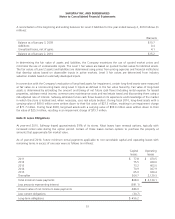

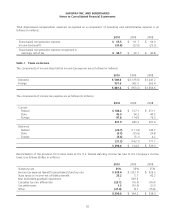

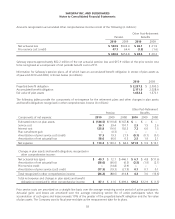

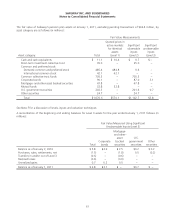

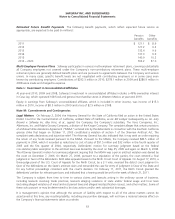

A reconciliation of the beginning and ending amount of unrecognized tax benefits follows (in millions):

2010 2009 2008

Balance at beginning of year $151.0 $129.2 $123.1

Additions based on tax positions related to the current year 4.3 4.1 11.7

Additions for tax positions of prior years 10.6 105.3 7.5

Reductions based on tax positions related to the current year –– (9.8)

Reductions for tax positions of prior years (4.7) (69.2) (2.8)

Additions related to changes in foreign currency translation 0.4 1.0 0.3

Expiration of statute of limitations (0.8) (0.9) –

Settlements (0.9) (18.5) (0.8)

Balance at end of year $159.9 $151.0 $129.2

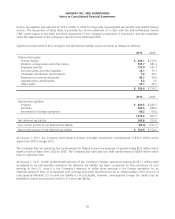

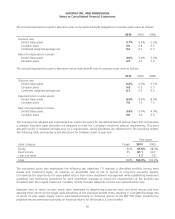

As of January 1, 2011, January 2, 2010 and January 3, 2009, the balance of unrecognized tax benefits included tax

positions of $43.7 million (net of tax), $37.4 million (net of tax) and $121.7 million (net of tax), respectively, that would

reduce the Company’s effective income tax rate if recognized in future periods.

Income tax expense in 2010, 2009 and 2008 included benefits of $0.5 million (net of tax), benefits of $10.0 million (net

of tax) and benefits of $4.8 million (net of tax), respectively, related to interest and penalties. As of January 1, 2011 and

January 2, 2010, the Company’s accrual for net interest and penalties was a liability of $2.0 million and $2.4 million,

respectively.

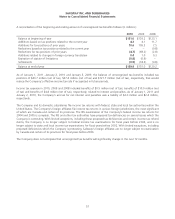

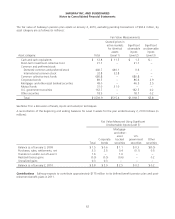

The Company and its domestic subsidiaries file income tax returns with federal, state and local tax authorities within the

United States. The Company’s foreign affiliates file income tax returns in various foreign jurisdictions, the most significant

of which are Canada and certain of its provinces. The IRS examination of the Company’s federal income tax returns for

2004 and 2005 is complete. The IRS and other tax authorities have proposed tax deficiencies on several issues which the

Company is contesting. With limited exceptions, including these proposed tax deficiencies and certain income tax refund

claims, the Company is no longer subject to federal income tax examinations for fiscal years before 2006, and is no

longer subject to state and local income tax examinations for fiscal years before 2002. With limited exceptions, including

proposed deficiencies which the Company is protesting, Safeway’s foreign affiliates are no longer subject to examination

by Canada and certain of its provinces for fiscal years before 2006.

The Company does not anticipate that unrecognized tax benefits will significantly change in the next 12 months.

57