Navy Federal Credit Union 2015 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NAVY FEDERAL CREDIT UNION6

Mortgage and Equity Loans

The U.S. real estate market posted its best sales numbers since 2007.

Navy Federal was there to help with flexible terms and continued low rates.

We closed more than 48,000 loans for a total of $12.3 billion, representing

Navy Federal’s best year on record. First-time homebuyers accounted for

55 percent of homebuyers, for a total of $4.1 billion. In May, we oered a

new Military Choice mortgage, giving us the ability to provide an excellent

loan option with 100 percent financing and a special, low rate to both

Active Duty members and veterans who may have already used their

VA eligibility.

As home values continued to increase in 2015, members looked to

Navy Federal for equity loans as a smart way to pay for large expenses

and finance home repairs and remodeling. Equity Lending closed nearly

12,000 loans for a total of $687.9 million, an increase of 16.0 percent

from last year. Home Equity Lines of Credit were our most popular

oering, thanks to their flexibility and unique 20-year open credit line.

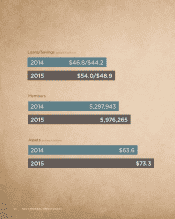

Student Loans

In April, we were pleased to announce the introduction of Navy Federal private student and

consolidation loans through a partnership with LendKey. Private student loans give members

a way to meet educational expenses when funding from Federal loans and scholarships are

not enough. By the end of 2015, Navy Federal helped make the dream of a college education

a reality for nearly 2,600 students attending 821 dierent colleges and universities. Our

student loan portfolio included a balance of $46.4 million from 3,183 loans.

At year end, our total assets reached $73.3 billion, an increase of $9.6 billion.

Total reserves, a measure of the credit union’s safety and soundness, reached $8.0 billion.

Navy Federal’s growth in 2015 is a testament to our commitment to provide our members

with excellent service whenever, wherever and however they want it.

REPORT OF THE CHAIRMAN & PRESIDENT

For some of our members,

being able to purchase a

home with no money down

is just what they need to

make homeownership a

reality. Nathan S. shared

this on Facebook:

“I love you guys. I’ve been

approved for the most

aordable mortgage with

no money down. I walk

around my oce with a

smile, and when people ask

why, I say ‘Navy Federal.’”

2015 In Review