Navy Federal Credit Union 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Section 47

2015—SHARED SUCCESS

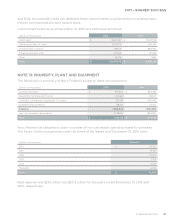

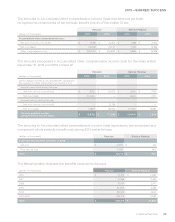

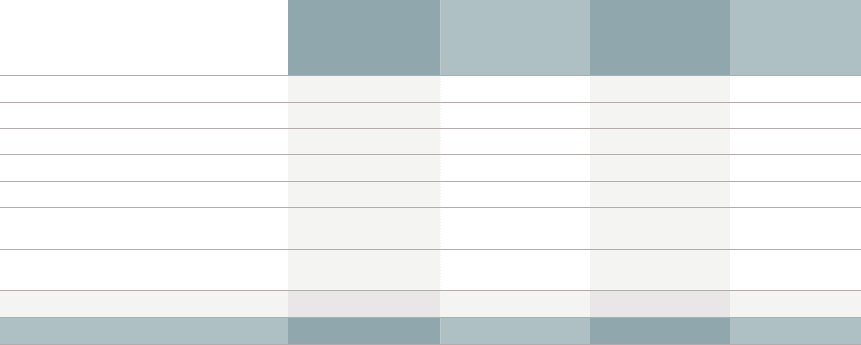

(dollars in thousands)

Year Ended December 31, 2014

Unrecognized

Net Pension and

Postretirement

Costs

Unrealized Net

Gains (Losses) on

Available-for-Sale

Securities

Unrealized Net

Gains (Losses)

on Cash Flow

Derivatives

Total

Balance, beginning of period $ (101,559) $ (97,024) $ 23,353 $ (175,230)

OCI before reclassifications (182,707) 254,308 (77,340) (5,739)

Amounts reclassified from AOCI to:

Salaries and employee benefits 3,906 — — 3,906

Net gain on sales of investments — (3,751) — (3,751)

Interest on securities sold under

repurchase agreements and notes payable — — 22,431 22,431

Interest income on

available-for-sale securities — — (2,012) (2,012)

Net change in AOCI (178,801) 250,557 (56,921) 14,835

Balance, end of period $ (280,360) $ 153,533 $ (33,568) $ (160,395)

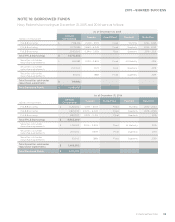

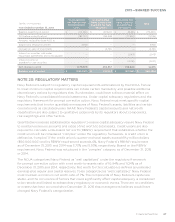

NOTE 20: REGULATORY MATTERS

Navy Federal is subject to regulatory capital requirements administered by the NCUA. Failure

to meet minimum capital requirements can initiate certain mandatory and possible additional

discretionary actions by regulators that, if undertaken, could have a direct material eect on

Navy Federal’s consolidated financial statements. Under capital adequacy regulations and the

regulatory framework for prompt corrective action, Navy Federal must meet specific capital

requirements that involve quantitative measures of Navy Federal’s assets, liabilities and certain

commitments as calculated under GAAP. Navy Federal’s capital amounts and net worth

classification are also subject to qualitative judgments by its regulators about components,

risk weightings and other factors.

Quantitative measures established by regulation to ensure capital adequacy require Navy Federal

to maintain minimum amounts and ratios of net worth to total assets. Credit unions are also

required to calculate a risk-based net worth (RBNW) requirement that establishes whether the

credit union will be considered “complex” under the regulatory framework. A credit union is

defined as “complex” if the credit union’s quarter-end total assets exceed fifty million dollars

($50,000,000) and its RBNW requirement exceeds 6%. Navy Federal’s RBNW requirement

as of December 31, 2015 and 2014 was 5.73% and 5.93%, respectively. Based on the RBNW

requirement, Navy Federal was not placed in the “complex” category as of December 31, 2015

or 2014.

The NCUA categorized Navy Federal as “well capitalized” under the regulatory framework

for prompt corrective action with a net worth-to-assets ratio of 10.94% and 11.24% as of

December 31, 2015 and 2014, respectively. Net worth for this calculation is defined as undivided

earnings plus regular and capital reserves. To be categorized as “well capitalized,” Navy Federal

must maintain a minimum net worth ratio of 7%. The components of Navy Federal’s capital are

stable, and the occurrence of factors that could significantly aect capital adequacy is considered

to be remote and limited to extraordinary regulatory or economic events. There are no conditions

or events that have occurred since December 31, 2015 that management believes would have

changed Navy Federal’s categorization.