Navy Federal Credit Union 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union42

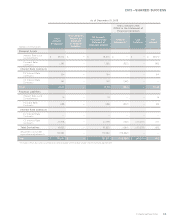

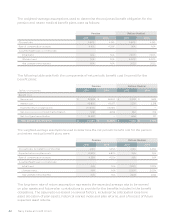

The weighted-average assumptions used to determine the projected benefit obligation for the

pension and retiree medical benefit plans were as follows:

Pension Retiree Medical

2015 2014 2015 2014

Discount rate 4.60% 4.15% 4.60% 4.15%

Rate of compensation increase 4.41% 4.25% N/A N /A

Assumed health care cost trend rate

Initial trend N /A N/A 7.00% 7.00%

Ultimate trend N /A N/A 5.00% 5.00%

Year ultimate trend reached N/A N /A 2022 2022

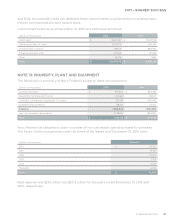

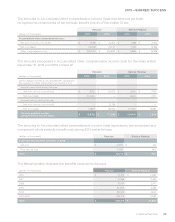

The following table sets forth the components of net periodic benefit cost (income) for the

benefit plans:

Pension Retiree Medical

(dollars in thousands) 2015 2014 2015 2014

Benefit Cost:

Service cost $ 32,593 $ 26,540 $ 2,002 $ 1,623

Interest cost 45,802 43,977 2,276 2,318

Expected return on plan assets (77,530) (76,137) — —

Net prior service cost/(credit) amortization 5,161 3,053 554 746

Net loss/(gain) amortization 14,540 — 606 107

Total benefit cost/(income) $ 20,566 $ (2,567) $ 5,438 $ 4,794

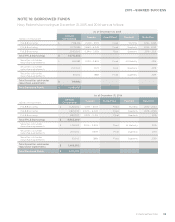

The weighted-average assumptions used to determine the net periodic benefit cost for the pension

and retiree medical benefit plans were:

Pension Retiree Medical

2015 2014 2015 2014

Discount rate: for benefit cost/(income) 4.15% 5.05% 4.15% 5.05%

Expected return on plan assets 6.50% 6.80% N/A N /A

Rate of compensation increase 4.25% 4.25% N/A N /A

Assumed health care cost trend rate

Initial trend N /A N/A 7.00% 7.00%

Ultimate trend N/A N /A 5.00% 5.00%

Year ultimate trend reached N /A N/A 2022 2022

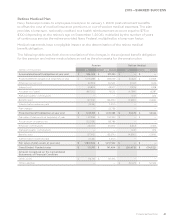

The long-term rate of return assumption represents the expected average rate to be earned

on plan assets and future plan contributions to provide for the benefits included in the benefit

obligations. The assumption is based on several factors, including the anticipated long-term

asset allocation of plan assets, historical market index and plan returns, and a forecast of future

expected asset returns.