Navy Federal Credit Union 2015 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Navy Federal Credit Union8

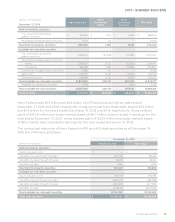

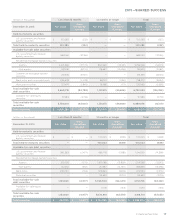

Loans

The Navy Federal loan portfolio consists of consumer, credit card and real estate loans. Consumer

loans consist of auto loans, signature loans, checking lines of credit and education loans. Real estate

loans consist of mortgage and equity loans. At origination, all consumer, credit card and equity

loans are classified as held for investment, and mortgage loans are classified as either mortgage

loans held for investment or mortgage loans awaiting sale (MLAS) based on management’s intent

and ability to hold or sell the loans.

In accordance with ASC 310, Receivables, loans, except for MLAS, are carried at the amount of

unpaid principal balance (UPB) adjusted for net deferred loan fees and costs, less an allowance

for loan losses. Interest is accrued on loans using the simple-interest method on the UPB on a

daily basis except for credit card loans, for which interest is calculated by applying the periodic

rate to the average daily balance outstanding on the member’s monthly statement date.

Loans are determined to be delinquent based on the contractual terms and are considered

delinquent when they are 30 days past due. When a loan becomes past due by more than 90

days, previously accrued interest is reversed and the loan is placed into non-accrual status.

Interest received on non-accrual status loans is accounted for on a cash basis. Loans are returned

to accrual status when all the principal and interest amounts contractually due are brought

current and future payments are reasonably assured.

Loan origination fees and certain direct origination costs are deferred and amortized over the

life of the loans using the interest method (eective yield) under ASC 310-20, Receivables—

Non-refundable Fees and Other Costs, for all products except for credit card loans, where

fees and costs are deferred and amortized on a straight-line basis annually.

A loan is considered impaired when, based on current information and events, it is probable

Navy Federal will be unable to collect all amounts due from the borrower in accordance with

the original contractual terms of the loans. Navy Federal reports loans as impaired based on the

method for measuring impairment in accordance with ASC 310-10, Receivables. MLAS are not

reported as impaired, as these loans are recorded at lower of cost or fair value. Loans defined as

individually impaired include business real estate loans and troubled debt restructuring (TDR) loans.

Allowance for Loan Losses

Navy Federal accrues estimated losses in accordance with ASC 450, Contingencies. The

allowance for loan losses is a reserve against Loans to members established through a provision

for loan losses charged to earnings. Loan losses are charged against the allowance when

management believes the collectability of the loan amount is unlikely. Recoveries on previously

charged-o loans are credited to the allowance.

The allowance for loan losses is evaluated monthly by management and is based on management’s

periodic review of the collectability of the loans based on prior historical experience, changes

in the value of loans outstanding, overall delinquency and delinquencies by loan product, and

current economic conditions and trends that may adversely aect a borrower’s ability to pay.

Loans that are not in foreclosure or undergoing a modification or repayment plan are typically

charged o to the allowance at 180 days past due.