Navy Federal Credit Union 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Financial Section 45

2015—SHARED SUCCESS

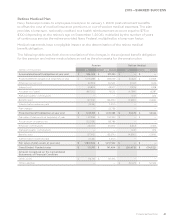

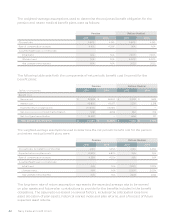

The following is a description of the valuation methodologies used for the Plan’s financial

instruments measured at fair value:

> U.S. Equity Securities (Level 2)—During the years ended December 31, 2015 and 2014, the

Plan invested in one common collective trust. The trust is valued at net asset value, which

is calculated based on the fair value of the underlying investments of the trust. Most of the

underlying investments in this trust are traded in markets that are considered to be active,

but the trust itself is not actively publicly traded, as it is marketed principally to institutional

investors. For those underlying investments that are not considered actively traded, the

values are based on quoted market prices, dealer quotations or valuations from pricing

sources supported by observable inputs. As such, the trust is classified within Level 2 of

the fair value hierarchy.

Interest in the trust can generally be purchased and redeemed daily with two days’ advance

notice. Trades are usually settled no later than three business days after the trade date.

> Intermediate-Term Fixed-Income Securities (Level 2)—The intermediate-term fixed-income

securities are generally valued using benchmark yields, reported trades and broker/dealer

quotes for similar assets in an active market. In addition, as of December 31, 2015 and 2014, the

Plan invested in one intermediate-term fixed-income security common collective trust. Most of

the underlying investments in this trust are traded in markets that are considered to be active,

but the trust itself is not actively publicly traded, as it is marketed principally to institutional

investors. As such, the trust is classified within Level 2 of the fair value hierarchy. Interest in

the trust can generally be purchased and redeemed daily with advance written notice of one

business day. Settlement of redemptions of more than $1 million will occur 10 business days

following the trade date.

There were no significant concentrations of risk within plan assets at December 31, 2015 and 2014,

as equity and fixed-income assets are broadly diversified.

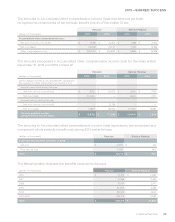

Navy Federal 401(k) Savings Plan

The Navy Federal 401(k) savings plan is a defined contribution plan where employees can

contribute up to the statutory limits to a 401(k) retirement account and receive employer

matching contributions. The matching contribution percentage is based on the formula the

employee receives in the defined benefit retirement plan. Employees eligible for the Cash Balance

benefit receive a 100% employer match on the first 7% of pay (6% of the pay for the year ended

December 31, 2014) they contribute to their 401(k) account up to IRS limits and are vested after

completing two years of service. The employees eligible for the Traditional benefit receive an

employer match of 50% on the first 7% of pay (6% of the pay for the year ended December 31,

2014) they contribute to their 401(k) account up to IRS limits.

The cost recognized for the 401(k) Plan, including matching contributions and administrative costs,

was $39.4 million and $28.6 million for the years ended December 31, 2015 and 2014, respectively.