Navy Federal Credit Union 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Section 51

2015—SHARED SUCCESS

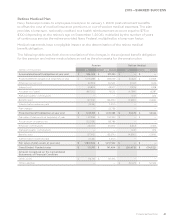

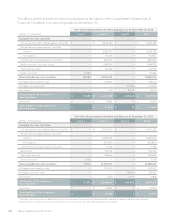

The following tables summarize the changes in fair value for items measured at Level 3 fair value

on a recurring basis using significant unobservable inputs at December 31:

Reconciliation of Level 3 Assets and Liabilities

as of December 31, 2015

(dollars in thousands)

Mortgage

Servicing Rights

Interest Rate Lock

Commitments—

Asset

Interest Rate Lock

Commitments—

Liability

Balance, beginning of year $ 235,801 $ 8,771 $ 3

Realized/Unrealized gain (loss)

included in earnings 4,059 19,515 37

Issuances/purchases 63,099 167,791 25

Settlements/sales (32,083) (177,507) (46)

Balance, end of year $ 270,876 $ 18,570 $ 19

Net unrealized gains (losses) related to assets

still held at December 31, 2015 $ (28,024) $ 18,570 $ 19

Reconciliation of Level 3 Assets and Liabilities

as of December 31, 2014

(dollars in thousands)

Mortgage

Servicing Rights

Interest Rate Lock

Commitments—

Asset

Interest Rate Lock

Commitments—

Liability

Balance, beginning of year $ 236,579 $ 5,593 $ 45

Realized/Unrealized gain (loss)

included in earnings (10,377) 15,243 (8)

Issuances/purchases 34,063 83,368 53

Settlements/sales (24,464) (95,433) (87)

Balance, end of year $ 235,801 $ 8,771 $ 3

Net unrealized gains (losses) related to assets

still held at December 31, 2014 $ (34,841) $ 8,771 $ 3

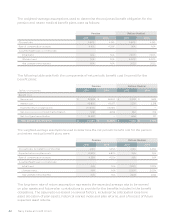

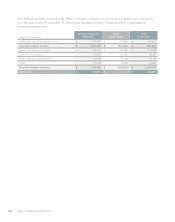

Financial Assets Accounted For at Fair Value on a Non-recurring Basis

Certain assets and liabilities may be required to be measured at fair value on a non-recurring

basis. These non-recurring fair value measurements usually result from the application of the

lower of cost or market accounting or the write-down of individual assets due to impairment.

The following is a description of the valuation methodologies used by Navy Federal for its assets

measured at fair value on a non-recurring basis:

Real Estate Owned

REO is recorded at the lower of cost or fair value less costs to sell. Navy Federal utilizes Broker

Price Opinions (BPOs) or home appraisals to estimate the fair market value of REO. A BPO

considers the value of similar surrounding properties, sales trends in the neighborhood and/or an

estimate of any of the costs associated with getting the property ready for sale. A home appraisal

involves a certified, state-licensed professional to determine the value of property by doing an

interior and exterior inspection of the subject property and a comparison to comparable home

sales. Fair value less costs to sell is an estimated value based on relevant recent historical data

that are considered unobservable inputs, and as such, REO is classified as Level 3 in the fair value

hierarchy and valued on a non-recurring basis.