Navy Federal Credit Union 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union34

eective portion of the hedge on the derivative instrument is reported as a component of other

comprehensive income and reclassified into earnings in the same period or periods that the

hedged transaction aects earnings. The ineective portion is recognized in current earnings in

the Consolidated Statements of Income.

During the next 12 months, net losses in AOCI of approximately $16.6 million on derivative

instruments that qualify as cash flow hedges are expected to be reclassified into earnings.

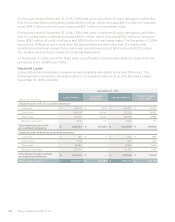

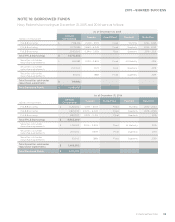

The table below summarizes gains and losses recognized in earnings related to Navy Federal’s

derivatives designated as cash flow hedges during the years ended December 31, 2015 and 2014.

For open or future cash flow hedges, the maximum length of time over which forecasted

transactions are or will be hedged is approximately 10 years.

(Loss)/Gain

Recognized in Other

Comprehensive Income

(Loss) Reclassified from Other

Comprehensive Income to

Income

(Loss)/Gain

Recognized in Income

(Ineective portion)

(dollars in thousands) 2015 2014 2015 2014 2015 2014

Interest rate contracts $ (27,342) $ (77,340) $ (20,170) $ (20,419) $ (21) $ (3)

Navy Federal clears its fair value and cash flow hedge interest rate swap trades through a DCO,

which requires the initial and ongoing posting of margin collateral. Additional collateral is required

for trades either in a net loss or net gain position. These margin requirements significantly reduce

Navy Federal’s exposure to counterparty risk. As of December 31, 2015 and 2014, Navy Federal

had margin collateral with brokers in the amount of $65.9 million and $36.2 million, respectively.

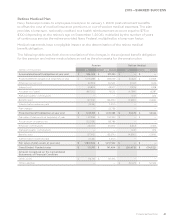

NOTE 10: BALANCE SHEET OFFSETTING

Navy Federal has entered into legally enforceable master netting agreements with various

counterparties that govern the purchase, sale, execution, clearing and carrying of its derivatives

and repurchase agreements. These agreements, in addition to separate margining provisions

that require collateral to be exchanged based on the direction and level of interest rates, reduce

Navy Federal’s exposure to counterparty risk. Under the master netting agreements, each of the

counterparties and Navy Federal agree to perform all of their respective obligations with respect

to all transactions and agree that upon failure to perform any of those obligations, all obligations

under all transactions become due and payable. Each party to the master netting agreement

has the right to oset what is owed to them by closing out, liquidating or netting any or all open

positions, including collateral.

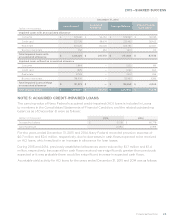

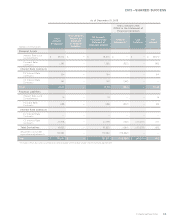

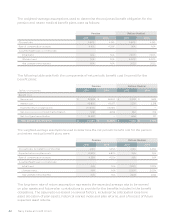

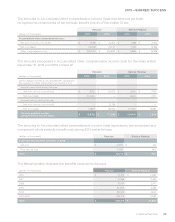

Navy Federal presents its derivative assets and liabilities on a gross basis in its Consolidated

Statements of Financial Condition. The following tables disclose the amounts eligible for oset

in Navy Federal’s Statements of Financial Condition as of December 31, 2015 and 2014: