Navy Federal Credit Union 2015 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union14

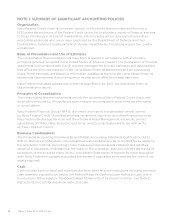

reporting period presented or retrospectively with the cumulative eect of initially applying this

guidance recognized at the date of initial application. Navy Federal is currently assessing the

impact on its consolidated financial statements.

In August 2014, the FASB issued ASU 2014-15, Presentation of Financial Statements—Going

Concern (Topic 205-40): Disclosure of Uncertainties about an Entity’s Ability to Continue as a

Going Concern, eective for annual reporting periods ending after December 15, 2016. This ASU

provides guidance about management’s responsibility to evaluate whether there is substantial

doubt about an entity’s ability to continue as a going concern and to provide related footnote

disclosures. This ASU is not expected to significantly impact Navy Federal’s consolidated

financial statements.

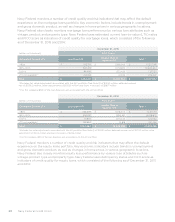

NOTE 2: RESTRICTIONS ON CASH

Navy Federal’s wholly owned entity, NFFG, had $2.6 million and $2.3 million in restricted cash

at December 31, 2015 and 2014, respectively. Restricted cash amounts are included in Other

assets in the Consolidated Statements of Financial Condition.

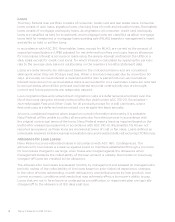

NOTE 3: INVESTMENTS

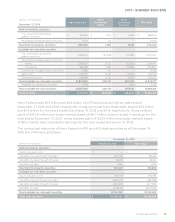

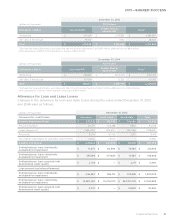

Navy Federal’s HTM and AFS securities as of December 31, 2015 and 2014 were as follows:

(dollars in thousands)

Amortized Cost

Gross

Unrealized

Gains

Gross

Unrealized

(Losses)

Fair Value

December 31, 2015

Held-to-maturity securities

U.S. government and federal

agency securities $ 307,808 $ 1,235 $ (232) $ 308,811

Residential mortgage-backed securities 6,819 26 — 6,845

Total held-to-maturity securities 314,627 1,261 (232) 315,656

Available-for-sale debt securities

U.S. government and federal

agency securities 4,923,422 79,376 (37,316) 4,965,482

Residential mortgage-backed securities

Agency 5,543,216 39,642 (53,103) 5,529,755

Non-agency 782,073 674 (21,182) 761,565

Commercial mortgage-backed securities 288,739 185 (3,604) 285,320

Bank notes and corporate bonds 1,952,958 11,021 (5,634) 1,958,345

Municipal securities 263,924 1,798 (3,556) 262,166

Total available-for-sale debt securities 13,754,332 132,696 (124,395) 13,762,633

Available-for-sale equity securities 99,999 — (2,716) 97,283

Total available-for-sale securities 13,854,331 132,696 (127,111) 13,859,916

Total securities $ 14,168,958 $ 133,957 $ (127,343) $ 14,175,572