Navy Federal Credit Union 2015 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

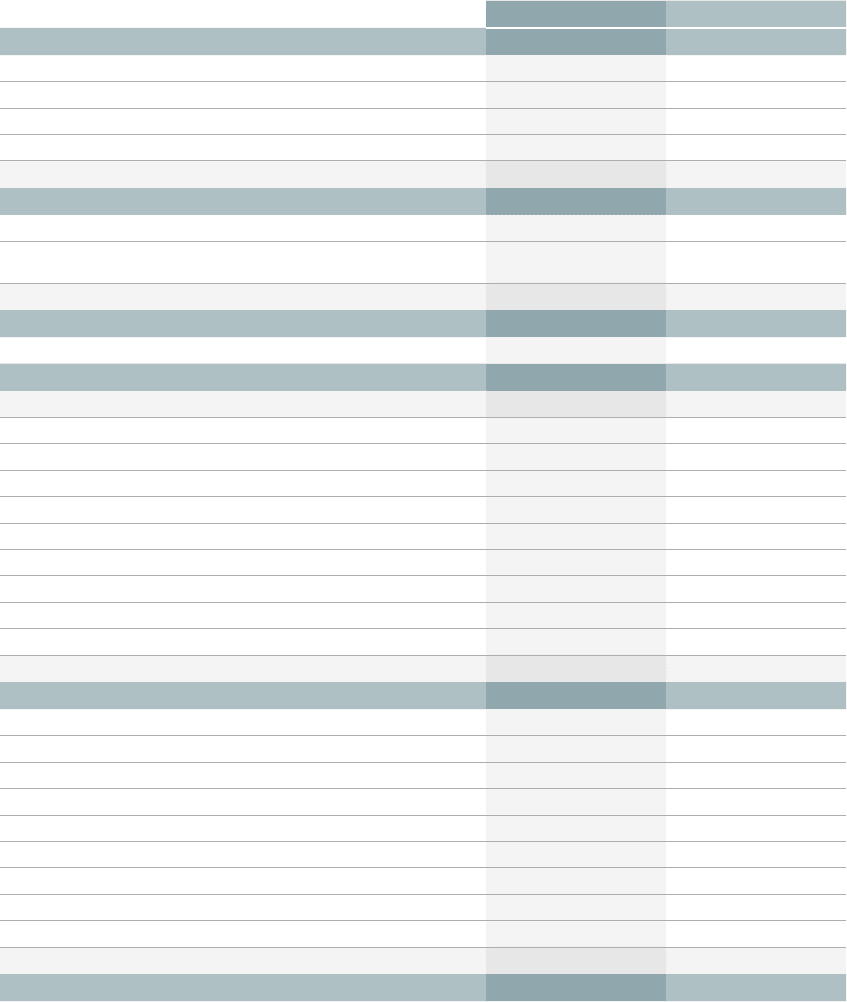

Financial Section 3

2015—SHARED SUCCESS

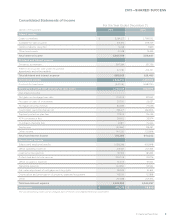

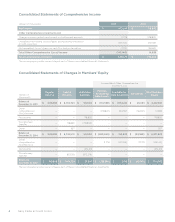

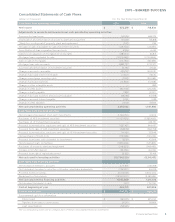

Consolidated Statements of Income

For the Year Ended December 31,

(dollars in thousands) 2015 2014

Interest income

Loans to members $ 3,264,271 $ 2,798,030

Available-for-sale securities 316,512 299,729

Held-to-maturity securities 5,768 7,389

Other investments 21,248 13,489

Total interest income 3,607,799 3,118,637

Dividend and interest expense

Dividends to members 387,284 351,756

Interest on securities sold under repurchase

agreements and notes payable 277,781 274,727

Total dividend and interest expense 665,065 626,483

Net interest income 2,942,734 2,492,154

Provision for loan losses (940,116) (668,279)

Net interest income after provision for loan losses 2,002,618 1,823,875

Non-interest income

Net gains on mortgage loan sales 173,005 87,490

Net gains on sales of investments 25,700 22,657

Mortgage servicing revenue 84,839 79,336

Credit/debit card interchange, net 296,471 266,803

Payment protection plan fees 117,309 115,433

ATM convenience fees 38,662 35,874

Overdrawn checking fees 81,817 73,464

Fee income 150,560 126,297

Other income 144,220 132,898

Total non-interest income 1,112,583 940,252

Non-interest expense

Salaries and employee benefits 1,058,286 905,848

Oce operating expenses 213,527 207,325

Loan servicing expenses 197,331 183,961

Professional and outside services 209,706 219,716

Oce occupancy expenses 72,009 67,922

Marketing expenses 104,550 92,552

Fair value adjustment of mortgage servicing rights 28,024 34,841

Depreciation and amortization of property, plant and equipment 143,061 123,818

Other 216,488 209,314

Total non-interest expense 2,242,982 2,045,297

Net income $ 872,219 $ 718,830

The accompanying notes are an integral part of these consolidated financial statements.