Navy Federal Credit Union 2015 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

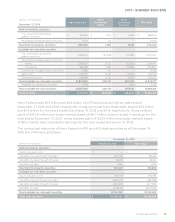

Navy Federal Credit Union16

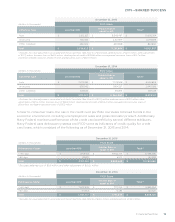

December 31, 2014

(dollars in thousands) Amortized Cost Fair Value

Held-to-maturity securities

Due in one year or less $ 49,933 $ 50,383

Due after one year through five years 263,899 264,159

Due after five years through ten years 53,424 53,849

Due after ten years 1,828 1,834

Total held-to-maturity securities 369,084 370,225

Available-for-sale debt securities

Due in one year or less 572,988 578,770

Due after one year through five years 3,825,411 3,891,202

Due after five years through ten years 2,274,440 2,316,338

Due after ten years 6,149,041 6,188,867

Total available-for-sale debt securities 12,821,880 12,975,177

Total debt securities $ 13,190,964 $ 13,345,402

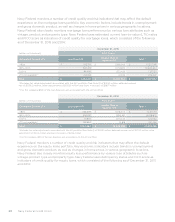

Navy Federal held $642.8 million of stock in the Federal Home Loan Bank (FHLB) of Atlanta as

of December 31, 2015. Navy Federal held $462.9 million of stock in the FHLB of Atlanta and

San Francisco as of December 31, 2014. FHLB stock is a restricted investment carried at cost

and evaluated for impairment. As a member of the FHLB system, Navy Federal has access to

a $17.6 billion line of credit facility.

All securities in an unrealized loss position were reviewed individually to determine whether

those losses were caused by an other-than-temporary decline in fair value. Navy Federal makes

a determination of whether unrealized losses are other-than-temporary based on the following

factors: whether Navy Federal intends to sell or hold the security until its costs can be recovered,

the nature of the security, the portion of unrealized losses that are attributable to credit losses

and the financial condition of the issuer of the security. Navy Federal does not intend to sell nor

would Navy Federal be, more likely than not, required to sell these securities before recovering

its amortized cost basis. The unrealized losses associated with these investments are not a result

of a change in the credit quality of the issuer; rather, the losses are reflective of changing market

interest rates. Therefore, Navy Federal expects to recover the entire cost basis of these securities.

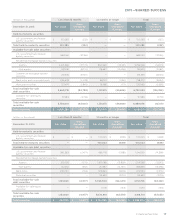

Navy Federal held 183 and 108 AFS securities in an unrealized loss position at December 31, 2015

and 2014, respectively. Navy Federal held one HTM security in an unrealized loss position at

December 31, 2015 and December 31, 2014. The following tables present these investments

at fair value and their associated gross unrealized losses broken down by the amount of time

the investments have been in a loss position: