Navy Federal Credit Union 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Section 55

2015—SHARED SUCCESS

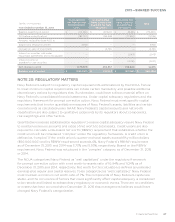

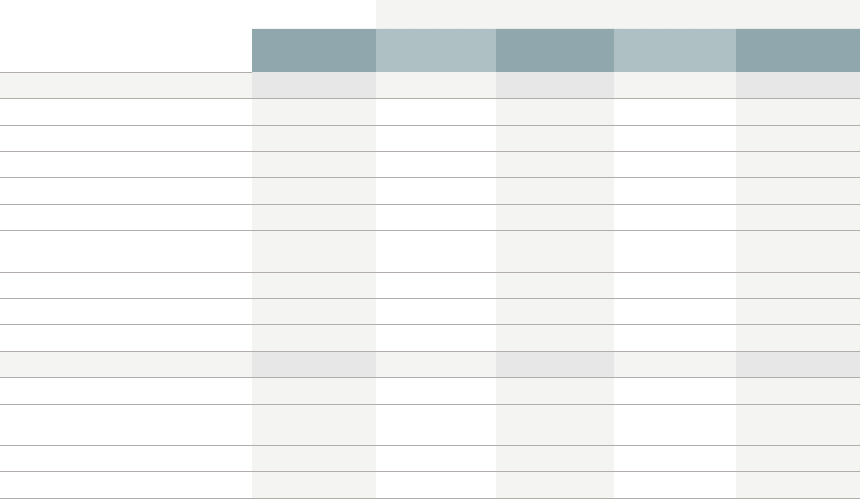

(dollars in thousands) Estimated Fair Value

December 31, 2014 Carrying

Amount Total Level 1 Level 2 Level 3

Financial assets:

Cash $ 426,201 $ 426,201 $ 426,201

Short-term investments 354,538 354,538 323,052 $ 31,486

Available-for-sale securities 12,986,192 12,986,192 12,986,192

Held-to-maturity securities 369,084 370,225 370,225

Mortgage loans awaiting sale 572,420 572,420 572,420

Loans to members, net of

allowance for loan losses 45,461,735 50,903,173 21,453,526 $ 29,449,647

Investments in FHLBs 462,878 462,878 462,878

Mortgage servicing rights 235,801 235,801 235,801

Other assets 16,090 16,090 2,047 14,043

Financial liabilities:

Members’ accounts 44,154,199 41,050,943 41,050,943

Securities sold under

repurchase agreements 1,469,502 1,472,615 1,472,615

Notes payable 9,942,200 10,327,671 10,327,671

Other liabilities 37,872 37,872 37,869 3

ASC 825-10, Fair Value of Financial Instruments—Disclosure, also requires the disclosure of all

significant concentrations of credit risk arising from financial instruments, whether from an

individual counterparty or groups of counterparties. Navy Federal has assessed the counterparty

credit risk on its financial instruments and has determined that it is not material to the

financial statements.

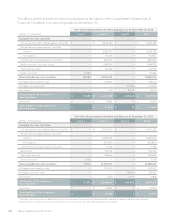

NOTE 23: REVISIONS TO PREVIOUSLY REPORTED FINANCIAL STATEMENTS

Management identified misclassifications in certain financial statement line items (listed below)

related to the classification of certain revenue and expense amounts related to the use of credit/

debit card interchanges and loan origination expense in previously reported Consolidated

Statement of Income for the year ended December 31, 2014.

Management evaluated the impact of these misclassifications on the previously reported financial

statements, presented herein, and concluded they did not, individually or in aggregate, result in a

material misstatement of Navy Federal’s previously reported consolidated financial statements.

Additionally, because these misclassifications did not result in any out-of-period adjustment, there

is no cumulative eect to be reflected in the 2015 financial statements. The misclassifications do not

have an impact on the previously reported net income as it amounted to a reclassification between

financial statement line items. Although the impact of these changes was not material to the

consolidated financial statements for the year ended December 31, 2014, management concluded

a revision of the respective financial statement line items for the year ended December 31, 2014

presented in the 2015 consolidated financial statements is appropriate. These corrections, noted

below, have no impact on Navy Federal’s financial position, results of operations, or regulatory

capital ratios for the year ended December 31, 2014.