Navy Federal Credit Union 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Section 33

2015—SHARED SUCCESS

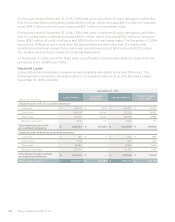

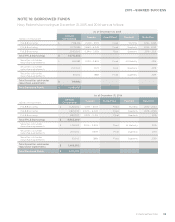

Gain/(Loss)

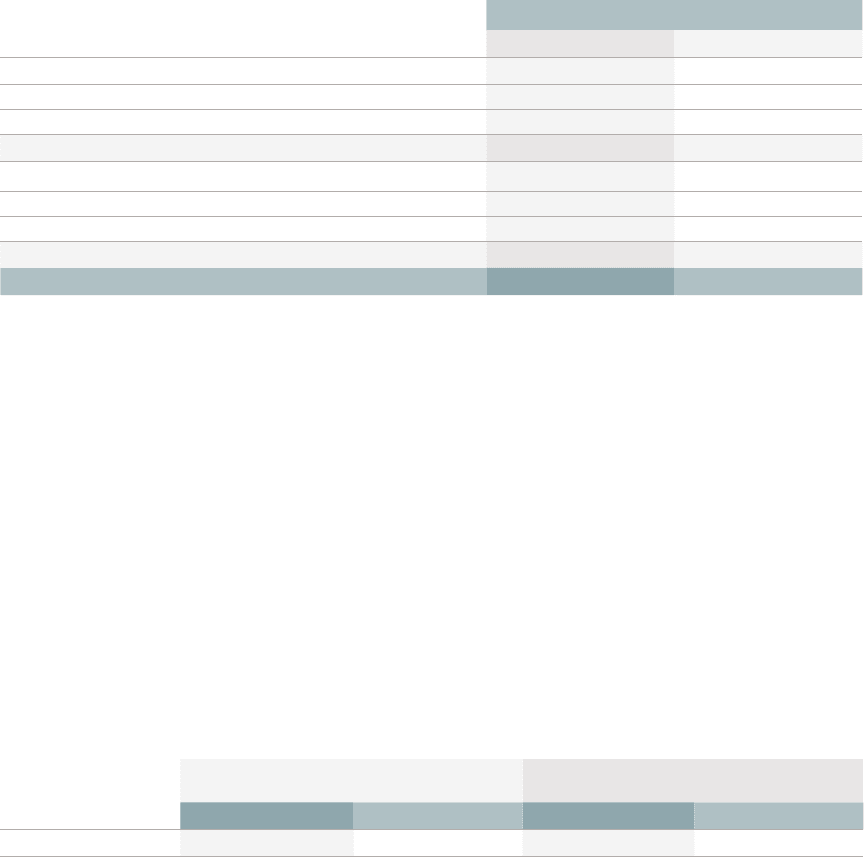

(dollars in thousands) 2015 2014

Interest Rate Lock Commitments

Gains $ 18,570 $ 8,771

(Losses) (19) (3)

Total $ 18,551 $ 8,768

Forward Sales Contracts

Gains $ 1,385 $ 943

(Losses) (688) (3,558)

Total 697 (2,615)

Grand Total $ 19,248 $ 6,153

Derivatives Accounted For as Qualifying Accounting Hedges

Under the provisions of ASC 815, Derivatives and Hedging, derivative instruments may be

designated as a qualifying fair value or cash flow hedge.

Fair Value Accounting Hedges

Navy Federal uses qualifying fair value hedges to protect certain fixed-rate investments

against the adverse changes in fair value attributable to changes in interest rates. For derivative

instruments that are designated and qualify as a fair value hedge under ASC 815, Derivatives and

Hedging, the gain or loss on the derivative instrument and the gain or loss on the hedged item

attributable to the hedged risk are recognized in current earnings. When interest rate fluctuations

cause changes in the fair value of fixed-rate investments, the gains or losses on the derivative

instruments are expected to be highly eective in providing an oset. Navy Federal includes the

unrealized gains or losses on its fair value hedge derivatives with the unrealized gain or loss on

the hedged instrument in Other income in the Consolidated Statements of Income.

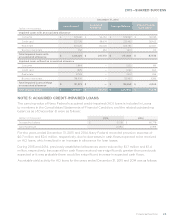

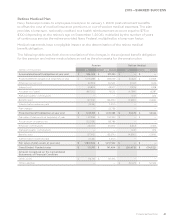

The table below summarizes gains and losses recognized in earnings related to Navy Federal’s

derivatives designated as fair value hedges during the years ended December 31, 2015 and 2014.

(Loss)/Gain Recognized in

Income on Derivative

Gain/(Loss) Recognized in

Income on Hedged Item

(dollars in thousands) 2015 2014 2015 2014

Interest rate contracts $ (297) $ (774) $ 354 $ 820

Navy Federal recognized $0.5 thousand in net losses and $5 thousand in net losses, in income

representing the ineectiveness of fair value hedges for the years ended December 31, 2015 and

2014, respectively.

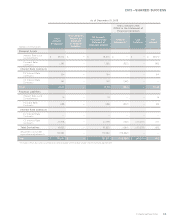

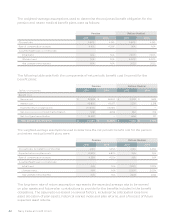

Cash Flow Accounting Hedges

Navy Federal funds a portion of its operations with variable rate obligations. Navy Federal

uses pay-fixed interest rate swaps to hedge the variability in cash flows related to existing and

anticipated replacement funding that reprices based on LIBOR. For derivative instruments that

are designated and qualify as cash flow hedges under ASC 815, Derivatives and Hedging, the