Navy Federal Credit Union 2015 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union26

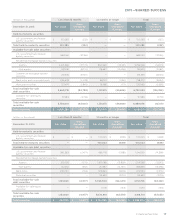

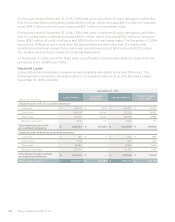

Accretable Yield

(dollars in thousands) 2015 2014

Balance, beginning of period $ 17,444 $ 19,493

Accretion (3,000) (3,049)

Net reclassification(1) 1,433 2,359

Removals (43) (1,359)

Balance, end of period $ 15,834 $ 17,444

(1)Includes transfers between accretable yield and non-accretable yield.

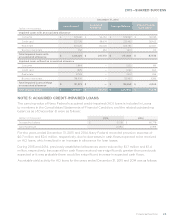

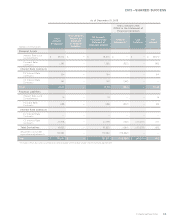

NOTE 6: LOAN SALES AND CONTINUING INVOLVEMENT

IN ASSETS TRANSFERRED

In the normal course of business, Navy Federal originates and transfers qualifying residential

mortgage loans in securitization or sales transactions in which we have continuing involvement.

Loans are sold to Federal National Mortgage Association (FNMA) and Federal Home Loan

Mortgage Corporation (FHLMC), who generally securitize the loans into mortgage-backed

securities that are sold to third-party investors in the secondary market or retained by Navy Federal

for investment purposes. Navy Federal, as an authorized Government National Mortgage

Association (GNMA) issuer/servicer, pools qualifying Federal Housing Administration (FHA)

and Department of Veterans Aairs (VA) insured loans into mortgage-backed securities that

are either sold to third-party investors in the secondary market or retained by Navy Federal for

investment purposes. From time to time, Navy Federal may also sell loans that were previously

retained for investment to private third-party investors.

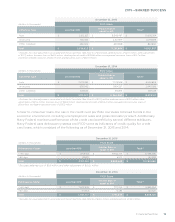

Navy Federal originated $12.3 billion and $8.0 billion, and sold/securitized $5.0 billion and $2.7

billion, of first mortgage loans during the years ended December 31, 2015 and 2014, respectively.

During the year ended December 31, 2015, Navy Federal reclassified $35.9 million of mortgage

loans from held for investment to MLAS. The loans were transferred to MLAS at fair value and

were subsequently measured at fair value until the loans were sold as part of a whole loan sale to

private investors for cash proceeds of $36.2 million and an MSR of $0.3 million. During the year

ended December 31, 2014, Navy Federal reclassified $43.8 million of mortgage loans from held

for investment to MLAS. The loans were transferred to MLAS at fair value and were subsequently

measured at fair value until the loans were sold as part of a whole loan sale to private investors

for cash proceeds of $44.0 million and an MSR of $0.4 million.

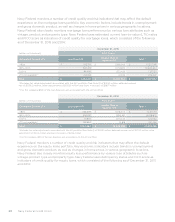

Gains and losses on the sale of MLAS are classified in the Consolidated Statements of Income as

Net gains on mortgage loan sales and totaled $173.0 million and $87.5 million for the years ended

December 31, 2015 and 2014, respectively. Navy Federal recorded $9.7 million and $11.4 million of

changes in MLAS fair value for the years ended December 31, 2015 and 2014, respectively, which

are classified as Net gains on mortgage loan sales in the Consolidated Statements of Income.

Navy Federal’s continuing involvement in loans transferred includes ongoing servicing,

repurchasing previously transferred loans under certain conditions, loss share agreements,

holding of mortgage-backed securities issued by securitization and obligations related to

standard representations and warranties. Navy Federal may also incur incremental obligations

related to various forms of credit enhancements aorded to third-party investors for securities

partially backed by the transferred loans.