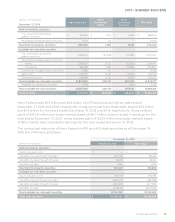

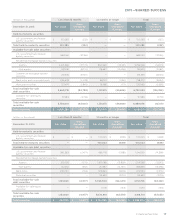

Navy Federal Credit Union 2015 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Financial Section 11

2015—SHARED SUCCESS

Gains or losses upon disposition are reflected in earnings as realized and included in Other

expenses in the Consolidated Statement of Income.

Navy Federal uses the straight-line method to account for its operating leases. Under this method,

Navy Federal divides the total contractual rent by the total term of the lease. The average monthly

rent is recorded as rent expense, and the remaining rent amount is deferred. Navy Federal reviews

its operating leases annually for the existence of asset retirement obligations that are accrued,

when material, pursuant to ASC 410-20, Asset Retirement Obligations.

NCUSIF Deposit

The deposit in the National Credit Union Share Insurance Fund (NCUSIF) is in accordance with the

Federal Credit Union Act and the National Credit Union Administration (NCUA) regulations, which

requires the maintenance of a deposit by each credit union in an amount equal to 1% of its insured

shares. The deposit would be refunded to Navy Federal if its insurance coverage is terminated or

the operations of the fund are transferred from the NCUA Board.

Goodwill

Goodwill represents the excess of purchase price over the fair value of net assets acquired in

business combinations. ASC 350-20, Intangibles—Goodwill and Other, provides that intangible

assets with finite useful lives be amortized and that goodwill and intangible assets with indefinite

lives be evaluated at least annually for impairment. Navy Federal evaluates goodwill for

impairment annually or more frequently should events or changes in circumstances occur that

would more likely than not reduce fair value to below carrying value. Impairment exists when the

carrying amount of goodwill exceeds its implied fair value. See Note 14: Goodwill for details.

Derivative Financial Instruments

Derivative financial instruments are financial contracts that derive their value from underlying

changes in assets, rates or indices. Derivatives are used to protect or hedge changes in prices or

interest rate movements that could adversely aect the value of certain assets or liabilities and

future cash flows.

Navy Federal accounts for its derivative financial instruments in accordance with ASC 815,

Derivatives and Hedging, which requires all derivative instruments to be carried at fair value

in the Consolidated Statements of Financial Condition. Navy Federal executes certain derivative

contracts over-the-counter and clears these transactions through a derivative clearing

organization (DCO). Some of Navy Federal’s derivatives are subject to legally enforceable

master netting agreements, which allow Navy Federal to settle positive and negative positions

and oset cash collateral held with the same counterparty on a net basis. Navy Federal does

not utilize a net presentation for derivative instruments in its Consolidated Statements of

Financial Condition. See Note 9: Derivative Instruments and Hedging Activities for details.

Economic Hedges

Navy Federal enters into mortgage loan commitments, also called interest rate lock commitments

(IRLCs), in connection with its mortgage banking activities to fund residential mortgage loans

at specified times in the future. The IRLCs that relate to mortgage loans Navy Federal intends

to sell are considered derivative instruments under applicable accounting guidance. IRLCs

expose Navy Federal to the risk that the price of the loans underlying the commitments may

decline between the inception of the rate lock and the funding date of the loan. Navy Federal

is exposed to further price risk after the funding date up to the time the mortgage loan is sold.

To protect against price risk, Navy Federal utilizes forward sales contracts. The IRLCs, forward