Navy Federal Credit Union 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union38

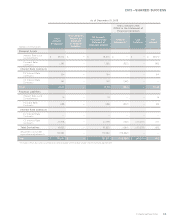

NOTE 14: GOODWILL

Navy Federal recognizes net assets acquired and liabilities assumed of acquired entities at

estimated fair value as of the acquisition date, subject to refinement as information relative

to the fair values at the date of acquisition becomes available. Navy Federal recorded $43.7

million of goodwill related to its acquisition of USAFCU on October 1, 2010. In accordance with

ASC 350-20, Goodwill and Other, goodwill is evaluated for impairment annually and upon any

changes in circumstances that could likely result in reducing the fair value of a reporting unit

below its carrying amount. Navy Federal performed a qualitative assessment of its goodwill as

of September 30, 2015 and 2014, pursuant to ASU 2011-08, Testing Goodwill for Impairment, and

concluded it was not likely the fair value of any reporting unit was below its carrying amount,

and therefore did not recognize any impairment charges.

The following table summarizes the carrying amount of goodwill:

(dollars in thousands) Carrying Value of Goodwill

December 31, 2013 $ 58,905

Adjustments during 2014 —

December 31, 2014 58,905

Adjustments during 2015 —

December 31, 2015 $ 58,905

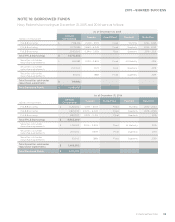

NOTE 15: MEMBERS’ ACCOUNTS

Interest rates on members’ share accounts are set by the Board of Directors and are based on

an evaluation of current and future market conditions. Interest on members’ accounts is based

on available earnings for each interest period and is not guaranteed by Navy Federal. In claims

against the assets of Navy Federal, such as in the event of its liquidation, Navy Federal members’

accounts are subordinate to other liabilities of Navy Federal.

The aggregate amount of time deposits, consisting of share certificates and IRA certificates,

that meet or exceed $250,000 was $1.8 billion and $1.5 billion at December 31, 2015 and

2014, respectively.

At December 31, 2015, scheduled maturities of time deposits, consisting of share certificates and

IRA certificates, were as follows:

(dollars in thousands) Amount

2016 $ 6,971,802

2017 3,425,899

2018 2,108,773

2019 1,210,376

2020 847,594

Thereafter 1,419,808

Total $ 15,984,252