Navy Federal Credit Union 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Section 27

2015—SHARED SUCCESS

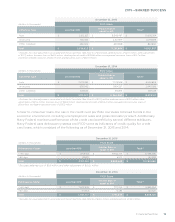

Servicing: Navy Federal retains mortgage servicing rights on loans transferred in sale transactions

and securitizations. Mortgage servicing rights are recognized at fair value on the date of sale or

securitization. See Note 7: Mortgage Servicing Rights for details. As of December 31, 2015 and

2014, the amount of loans serviced by Navy Federal for outside investors was $22.3 billion and

$20.1 billion, respectively.

Navy Federal earns servicing and other ancillary fees for our role as servicer. Navy Federal’s

servicing fees are priced based on minimum rates required by FNMA, FHLMC and the GNMA.

During the years ended December 31, 2015 and 2014, Navy Federal’s servicing revenue was $84.8

million and $79.3 million, respectively, for mortgage loan servicing fees, which is included in

Mortgage servicing revenue in the Consolidated Statements of Income. During the years ended

December 31, 2015 and 2014, Navy Federal received $1.5 million and $1.2 million, respectively,

of late charges and miscellaneous fees, which is included in Other income in the Consolidated

Statements of Income.

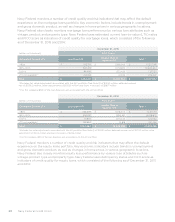

Navy Federal’s responsibilities as servicer typically include collecting and remitting monthly

principal and interest payments, maintaining escrow deposits, performing loss mitigation and

foreclosure activities, and in certain instances, funding servicing advances that have not yet been

collected from the borrower. Navy Federal recognizes servicing advances that are reimbursable

as Accounts receivable in its Consolidated Statements of Financial Condition. Servicing advances

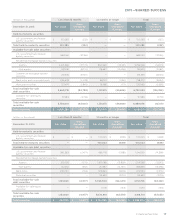

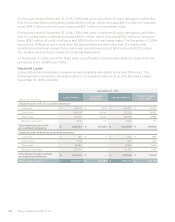

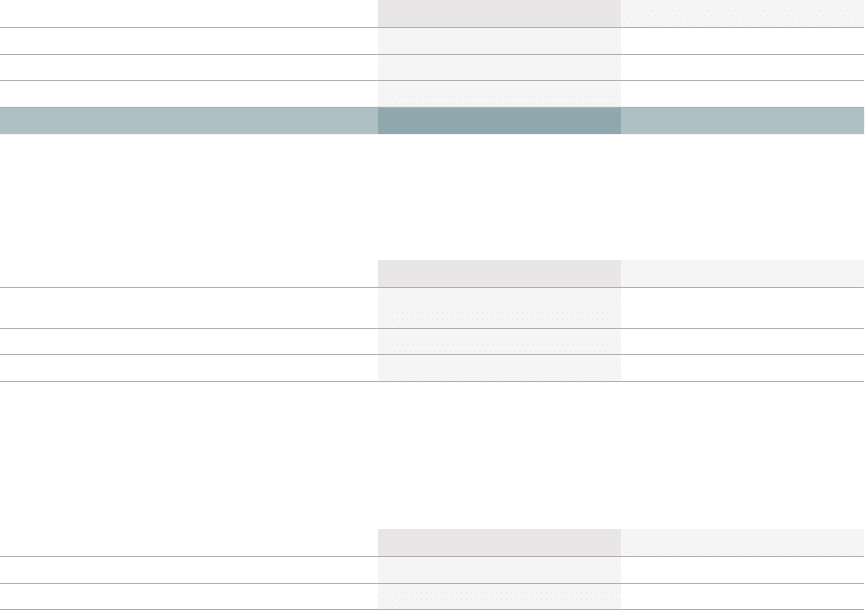

as of December 31, 2015 and 2014 were as follows:

(dollars in thousands) 2015 2014

Escrow advances $ 17,003 $ 15,666

Principal and interest advances 806 1,461

Other advances(1) 6,323 8,724

Total $ 24,132 $ 25,851

(1)Includes recoverable advances related to mortgage defaults, such as bankruptcy attorney fees and foreclosure costs.

The following table provides a summary of the cash flows exchanged between Navy Federal and

transferees on all loans transferred during the years ended December 31, 2015 and 2014:

(dollars in thousands) 2015 2014

Cash from sale of mortgage loans and

mortgage-backed securities $ 5,145,466 $ 2,818,283

Repurchase of previously transferred loans 6,599 8,995

Contractual servicing fees received 84,839 79,336

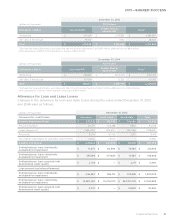

The following table provides the outstanding and delinquent loan balances of transferred

loans for which Navy Federal retains servicing rights. These amounts are excluded from the

Consolidated Statements of Financial Position as they meet the definition of sale under ASC

860-10, Transfers and Servicing.

(dollars in thousands) 2015 2014

Principal balances of loans serviced $ 22,321,616 $ 20,060,421

Delinquent loans(1) 162,581 166,584

(1)Serviced delinquent loans are 60 days or more past due.