Navy Federal Credit Union 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Navy Federal Credit Union48

Federal Reserve requires us to maintain a cash reserve balance with the Federal Reserve Bank

(FRB). At December 31, 2015 and 2014, the balance outstanding at the FRB was $106.9 million

and $70.5 million, respectively.

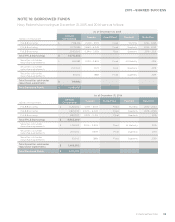

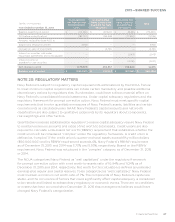

NOTE 21: FAIR VALUE MEASUREMENT

ASC 820-10, Fair Value Measurements and Disclosures, requires Navy Federal to determine

the fair values of its financial instruments based on the fair value hierarchy established in

that standard, which requires an entity to maximize the use of quoted prices and observable

inputs when measuring fair value. A description of the fair value hierarchy is as follows:

> Level 1—Valuation is based upon quoted prices for identical instruments traded in

active markets.

> Level 2—Valuation is based upon observable inputs such as quoted prices for similar

instruments in active markets, quoted prices for identical or similar instruments in markets

that are not active and model-based valuation techniques for which all significant assumptions

are observable in the market.

> Level 3—Valuation is based upon unobservable inputs that are supported by little or no

market activity and are significant to the fair value of the instrument. Valuation is typically

performed using pricing models, discounted cash flow methodologies or similar techniques,

which incorporate management’s own estimates of assumptions that market participants

would use in pricing the instrument, or valuations that require significant management

judgment or estimation.

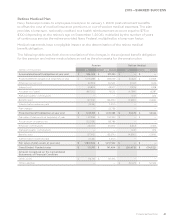

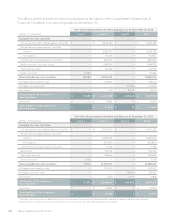

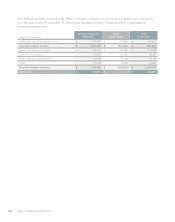

Financial Assets Accounted For at Fair Value on a Recurring Basis

The following is a description of the valuation methodologies used by Navy Federal for its assets

and liabilities measured at fair value on a recurring basis:

Available-for-Sale Securities

Navy Federal receives pricing for AFS securities from a third-party pricing service. These

securities are classified as Level 2 in the fair value hierarchy.

> Residential and Commercial Mortgage-Backed Securities—Residential and commercial

mortgage-backed securities include agency and non-agency securities, and are valued either

based on similar assets in the marketplace and the vintage of the underlying collateral, or at

the closing price reported in the active market in which the individual security is traded.

> Federal Agency Securities, Treasury Securities, Municipal Securities and Bank Notes—

Federal agency securities, treasury securities, municipal securities and bank notes are valued

based on similar assets in the marketplace and the vintage of the underlying collateral, or at

the closing price reported in the active market in which the individual security is traded.