Navy Federal Credit Union 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Section 29

2015—SHARED SUCCESS

Financial Guarantees Related to Recourse Provided in Assets Transferred

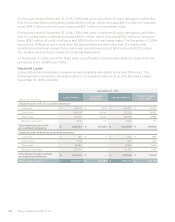

Representations and Warranties: For mortgage loans transferred in sale transactions or

securitizations to FNMA, FHLMC and GNMA, Navy Federal has made representations and

warranties that the loans meet their requirements. These requirements typically relate to

collateral, underwriting standards, validation of certain borrower representations in connection

with the loan and the use of standard legal documentation. In connection with the sale of loans

to FNMA, FHLMC and GNMA, Navy Federal may be required to repurchase loans or indemnify

the respective entity for losses due to breaches of these representations and warranties.

Navy Federal recognizes a liability for estimated losses related to representations and warranties

from the inception of the obligation when the loans are sold. This liability is included in Other

liabilities in the Consolidated Statements of Financial Condition. In the Consolidated Statements

of Income, the related expense is included as an oset to Net gains on mortgage loan sales for

loans sold during the current period, or in Loan servicing expenses for re-measurement of the

liability on loans sold in prior periods. Navy Federal’s estimated representations and warranties

liability at December 31, 2015 and 2014 was $33.2 million and $30.9 million, respectively.

Management believes the recognized liability for representations and warranties appropriately

reflects the estimated probable losses on indemnification and repurchase claims for all loans sold

and outstanding as of December 31, 2015 and 2014. In making these estimates, Navy Federal

considers the losses expected to be incurred over the life of the sold loans. While management

seeks to obtain all relevant information in estimating this liability, the estimation process is

inherently uncertain and imprecise and, accordingly, it is reasonably possible future losses could

be more or less than Navy Federal’s established liability. At December 31, 2015, Navy Federal

estimates it is reasonably possible it could incur additional losses in excess of its accrued liability

of up to approximately $44.9 million.

The total UPB subject to representations and warranties was $22.1 billion and $19.8 billion as of

December 31, 2015 and 2014, respectively.

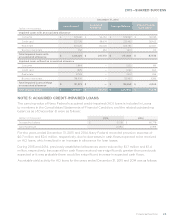

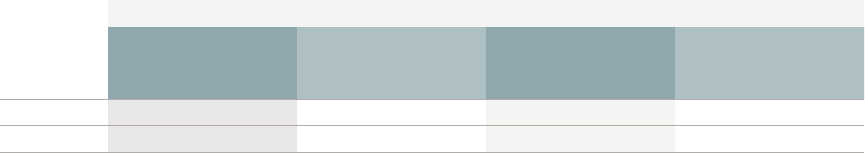

FHLMC Loss-Sharing Agreements: Navy Federal sold mortgage loans to FHLMC under loss-

sharing agreements from years 2011 to 2015, whereby Navy Federal must indemnify FHLMC

for losses related to loans with higher LTV ratios and no private mortgage insurance that occur

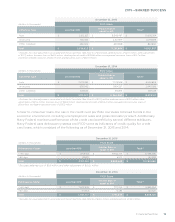

during a period of three to four years from the applicable settlement date. The following table

summarizes proceeds received for sales of loans and payments made for losses under these

agreements during the years ended December 31, 2015 and 2014:

FHLMC

(dollars in

thousands)

Outstanding UPB of

Loans Sold to FHLMC

as of 12/31

Maximum Future

Exposure Under Loss-

Sharing Agreements

Losses Paid to FHLMC

during the year ended

12/31

Liability for

Estimated Losses

as of 12/31

2015 $ 527,765 $ 10,930 $ 140 $ 71

2014 826,312 30,434 350 324