Navy Federal Credit Union 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union28

Retained investment in GNMA Securities: GNMA securities backed by Navy Federal loans may

be retained as investments by Navy Federal and classified as AFS securities. AFS investments

are carried at fair value with changes in fair value recognized in AOCI. See Note 3: Investments

for details.

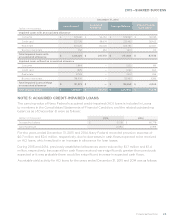

In accordance with ASC 860-20, Secured Borrowing and Collateral, the eect of two negative

changes in each of the key assumptions used to determine the fair value of Navy Federal’s

investment in GNMA securities must be disclosed. The negative eect of each key assumption

change must be calculated independently, holding all other assumptions constant. The first

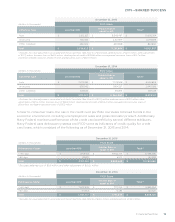

table below details the key assumptions used in Navy Federal’s analysis—specifically, constant

prepayment rate (CPR), anticipated credit losses and weighted-average life. The second table

below details the potential impacts of a 10% and 20% adverse change to the CPR on the fair

value of the securities.

GNMA Securities

2015 2014

Weighted-average constant prepayment rate (CPR)(1) 9.1% 8.8%

Anticipated credit losses(2) 0 0

Weighted-average life 5.36 years 5.38 years

(1)CPR is based on the average of the CPR for all GNMA securities.

(2)GNMA securities are collateralized by government-insured loans and there is no anticipation of significant credit losses.

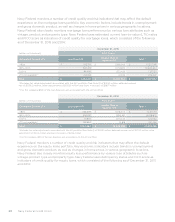

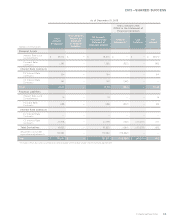

GNMA Securities

(dollars in thousands) 2015 2014

Constant prepayment rate

Decline in fair value from 10% adverse change $ 1,306 $ 1,928

Decline in fair value from 20% adverse change 2,549 3,739

The sensitivities in the table above are hypothetical and may not be indicative of actual results.

The eect of a variation in a particular assumption on the fair value is calculated independently of

changes in other assumptions. Further, changes in fair value based on variations in assumptions

generally cannot be extrapolated because the relationship of the change in assumption on the

fair value may not be linear.

Fair value of GNMA securities held by Navy Federal was $1.2 billion and $1.4 billion as of

December 31, 2015 and 2014, respectively.

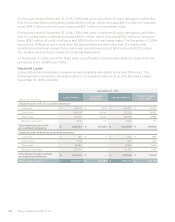

GNMA Early Pool Buyback Program: Navy Federal has the option to repurchase pooled loans

out of GNMA securities when members fail to make payments for three consecutive months

(pursuant to the GNMA Early Pool Buyback Program). Since Navy Federal has the unilateral

ability to repurchase these delinquent loans, its eective control over the loans has been regained.

Navy Federal recognizes an asset and a corresponding liability regardless of whether it has the

actual intent to repurchase the loans. At December 31, 2015 and 2014, unpaid principal balances

recognized in MLAS and Other liabilities associated with the Early Pool Buyback Program totaled

$52.5 million and $34.3 million, respectively.