Navy Federal Credit Union 2015 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Financial Section 9

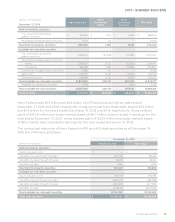

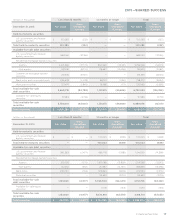

2015—SHARED SUCCESS

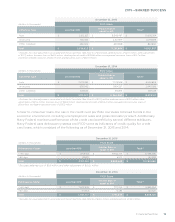

Navy Federal’s loan portfolio consists mainly of large groups of smaller-balance homogeneous

loans that are collectively evaluated for impairment. The allowance for loan losses is maintained at

a level that, in management’s judgment, is sucient to absorb losses inherent in the portfolio based

on evaluations of the collectability of loans and prior loan loss experience. The allowance for loan

losses is subject to estimates and uncertainties associated with the factors and processes used to

determine the amount; the actual outcome may dier from the estimate.

Navy Federal also maintains an allowance for unfunded commitments at a level that is appropriate

to absorb estimated probable credit losses. The allowance is derived in a manner similar to

the methodology used for determining the allowance for loans to members. The allowance for

unfunded commitments is recorded in Other liabilities in the Consolidated Statements of Financial

Condition. Provision expense for unfunded commitments is included in the Provision for loan

losses in the Consolidated Statements of Income.

Mortgage Loans Awaiting Sale

At origination, mortgage loans are classified as either mortgage loans held for investment or

MLAS based on the strategy and management’s intent and ability to hold or sell. The initial loan

level basis for MLAS is equal to unpaid principal balance plus or minus origination costs and fees.

Interest income on MLAS is recorded as earned and reported on the Consolidated Statements

of Income in Interest income—Loans to members. ASC 825-10, Financial Instruments—Fair Value

Option, permits entities to irrevocably elect to measure many financial instruments and certain

other items at fair value. Navy Federal elects the fair value option for MLAS, and subsequent

changes to estimated fair value are recognized in the Consolidated Statements of Income. MLAS

are sold with the mortgage servicing rights retained by Navy Federal. Loans are removed from

the Consolidated Statements of Financial Condition as assets and sales treatment is applied when,

in accordance with ASC 860-10, Transfers and Servicing, the conditions for sale of financial

assets are met.

Mortgage Servicing Rights

Navy Federal recognizes mortgage servicing rights (MSRs) when mortgage loans are sold and

Navy Federal retains the right to service those loans. Navy Federal recognizes MSRs at fair value

with changes in fair value recognized in Fair value adjustment of mortgage servicing rights in the

Consolidated Statements of Income.

Acquired Credit-Impaired Loans

ASC 310-30, Loans and Debt Securities Acquired with Deteriorated Credit Quality, addresses

accounting for dierences, attributable to credit quality, between contractual cash flows

and cash flows expected to be collected from an investor’s initial investment in loans or debt

securities acquired in a transfer. Acquired loans are considered to be impaired if Navy Federal

does not expect to receive all contractually required cash flows and the loans have exhibited

credit deterioration since origination. Credit deterioration can be evidenced by lower FICO

score or past-due status. Acquired credit-impaired (ACI) loans are recorded at fair value at

acquisition, determined by discounting expected future cash flows. The excess of the expected

future cash flows on ACI loans over the recorded investment is referred to as accretable yield,

which is recognized as interest income over the remaining life of the loan using an eective yield

methodology. The dierence between contractually required payments at acquisition date,

considering the impact of prepayments and credit losses expected over the life of the loan, and

the cash flows expected to be collected is referred to as the non-accretable dierence.