Navy Federal Credit Union 2015 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Navy Federal Credit Union12

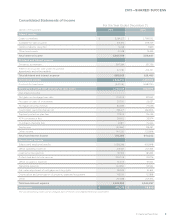

sales contracts and mortgage loans Navy Federal intends to sell are recorded at fair value with

changes in fair value included in Net gains on mortgage loan sales in the Consolidated Statements

of Income.

Accounting Hedges

Under the provisions of ASC 815, Derivatives and Hedging, derivative instruments can be

designated as fair value hedges or cash flow hedges.

Fair value hedges are used to protect against changes in the fair value of assets and liabilities

that are attributable to interest rate volatility. Navy Federal uses interest rate swaps as fair value

hedges against the value of its fixed-rate AFS securities.

Cash flow hedges are used primarily to minimize the variability in cash flows of assets or liabilities

or forecasted transactions caused by interest rate fluctuations. Navy Federal uses interest rate

swaps to hedge against the variability in cash flows of its floating-rate debt payments and

forecasted replacement debt.

At the inception of hedge relationships, Navy Federal formally documents the hedged item, the

particular risk management objective, the nature of the risk being hedged, the derivative being

used, how eectiveness of the hedge will be assessed and how ineectiveness of the hedge will

be measured. Navy Federal primarily uses regression analysis at the inception of a hedge and for

each reporting period thereafter to assess whether the derivative used in a hedging transaction

is expected to be, and has been, highly eective in osetting changes in the fair value or cash

flows of a hedged item.

Navy Federal discontinues hedge accounting when it is determined the derivative is not expected

to be or has ceased to be highly eective as a hedge; the derivative expires or is sold, terminated or

exercised; the derivative is de-designated; or for a cash flow hedge, it is no longer probable that

the forecasted transaction will occur by the end of the originally specified time frame. Subsequent

to discontinuing a fair value or cash flow hedge, the derivative will continue to be recorded on

the balance sheet at fair value, with changes in fair value included in earnings. For a discontinued

fair value hedge, the previously hedged item is no longer adjusted for changes in fair value. For

a discontinued cash flow hedge that is discontinued because the forecasted transaction is no

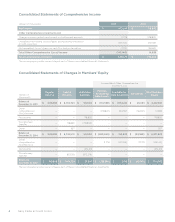

longer probable to occur, the previously unrealized gain or loss in AOCI is recognized in earnings

immediately; otherwise, for the other discontinuing type events, the unrealized gain or loss

continues to be deferred in AOCI until the forecasted transaction aects earnings. Navy Federal

did not discontinue hedge accounting for any hedges in either 2015 or 2014.

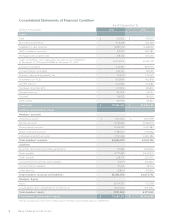

All derivative financial instruments are recognized at fair value and classified as Other assets or

Other liabilities in the Consolidated Statements of Financial Condition. See Note 9: Derivative

Instruments and Hedging Activities for details.

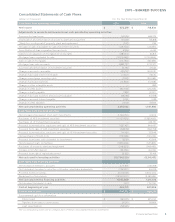

Pension Accounting and Retirement Benefit Plans

Navy Federal has a defined benefit pension plan, 401(k) defined contribution and 457(b)

savings plans, and a non-qualified supplemental retirement plan. Navy Federal also provides a

postretirement medical plan for certain retired employees. Navy Federal accounts for its defined

benefit pension plans in accordance with ASC 715, Compensation—Retirement Benefits. See

Note 17: Retirement Benefit Plans for details.