Navy Federal Credit Union 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union46

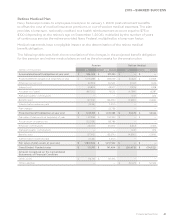

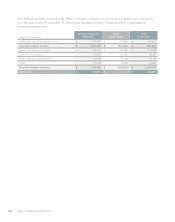

Deferred Compensation Plan

The Navy Federal 457(b) deferred compensation plan is a non-qualified plan that oers a before-

tax savings opportunity to highly compensated employees. The annual deferral amount allowed

mirrors the 401(k) Plan limits, and contributions held by Navy Federal earn monthly interest

based on Navy Federal’s monthly gross income divided by average earnings on assets (loans

and investments).

Non-Qualified Supplemental Retirement Plans

The non-qualified supplemental retirement plans are primarily designed to “make up” for benefits

not paid through the qualified retirement plans as a result of IRS limitations. Internal Revenue

Code Section 401(a)(17) limits the amount of compensation that can be used in a qualified

retirement plan calculation, and Internal Revenue Code Section 415 limits the amount of monthly

annuity that can be paid from a defined benefit plan.

All benefits are paid from Navy Federal’s assets and are in compliance with all federal laws and

regulations. As of December 31, 2015 and 2014, total liability related to these plans was $10.3

million and $9.6 million, respectively.

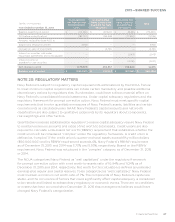

NOTE 18: RELATED PARTY TRANSACTIONS

In the normal course of business, Navy Federal extends loans and receives deposits from

credit union ocials. Credit union ocials are defined as volunteer members of the Board of

Directors and board committees, and employees with the title of Vice President and above. The

total outstanding loan balances extended to ocials as of December 31, 2015 and 2014 were

$37.3 million and $33.4 million, respectively. Total deposit balances received from ocials as of

December 31, 2015 and 2014 were $10.9 million and $9.5 million, respectively. Loans were made

at the same rates and terms as those available to all other members of the Credit Union. Deposit

accounts earned interest at the same rates provided to all other members of the Credit Union.

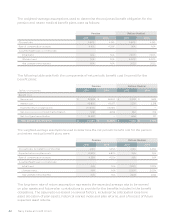

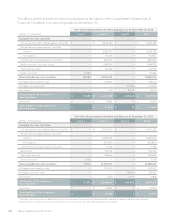

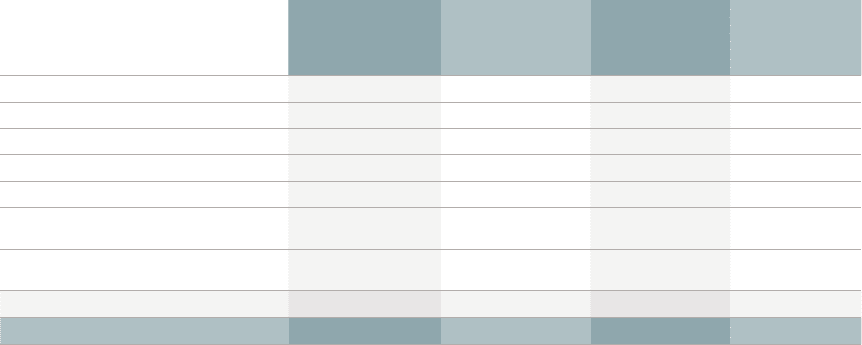

NOTE 19: ACCUMULATED OTHER COMPREHENSIVE INCOME/(LOSS)

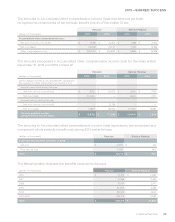

Details of accumulated other comprehensive income (loss) are as follows:

(dollars in thousands)

Year Ended December 31, 2015

Unrecognized

Net Pension and

Postretirement

Costs

Unrealized Net

Gains (Losses) on

Available-for-Sale

Securities

Unrealized Net

Gains (Losses)

on Cash Flow

Derivatives

Total

Balance, beginning of period $ (280,360) $ 153,533 $ (33,568) $ (160,395)

OCI before reclassifications (9,085) (126,359) (27,342) (162,786)

Amounts reclassified from AOCI to:

Salaries and employee benefits 20,861 — — 20,861

Net gain on sales of investments — (21,385) — (21,385)

Interest on securities sold under

repurchase agreements and notes payable — — 22,679 22,679

Interest income on

available-for-sale securities — — (2,509) (2,509)

Net change in AOCI 11,776 (147,744) (7,172) (143,140)

Balance, end of period $ (268,584) $ 5,789 $ (40,740) $ (303,535)