Navy Federal Credit Union 2015 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union10

Each quarter, Navy Federal re-evaluates the performance and credit quality of its ACI loans by

aggregating individual loans that have common risk characteristics and estimating their expected

future cash flows. Decreases in expected or actual cash flows that are attributable, at least in

part, to credit quality are charged to the provision for loan losses resulting in an increase in the

allowance for loan losses. Conversely, increases in expected or actual cash flows are treated as a

recovery of any previously recorded allowance for loan losses, and to the extent applicable, are

reclassified from non-accretable dierence to accretable yield.

Navy Federal’s ACI loans are accounted for in pools. Loans deemed uncollectible on an individual

basis remain in the pool and are not reported as charge-os. Disposals of loans, whether through

sale or foreclosure, result in the loan’s removal from the pool at its carrying amount. See Note 5:

Acquired Credit-Impaired Loans for details.

Troubled Debt Restructurings

A troubled debt restructuring (TDR) is a loan for which Navy Federal has granted a concession

it would not otherwise consider because that member is experiencing financial diculty.

The types of concessions Navy Federal grants in a TDR primarily include term extensions and

interest rate reductions. TDR loans are accounted for in accordance with ASC 310-40, Troubled

Debt Restructurings by Creditors. See Note 4: Loans and Allowance for Loans and Lease Losses

for details.

Real Estate Owned

Navy Federal obtains real estate owned (REO) through foreclosure proceedings or when a

delinquent borrower chooses to transfer a mortgaged property in lieu of foreclosure. REO is

initially recorded at fair value less estimated costs to sell and is included in Other assets in the

Consolidated Statements of Financial Condition. After acquisition, REO is carried at the lower of

cost or fair value less costs to sell. Holding period maintenance costs are expensed as incurred.

Valuation adjustments, holding period maintenance costs and gains/losses on disposal are

included in Other expense in the Consolidated Statements of Income.

Property, Plant and Equipment

Land is carried at cost. Buildings, furniture, fixtures, equipment, computer software and

capitalized information technology (IT) projects are carried at cost less accumulated depreciation

and amortization, which are computed on a straight-line basis over the assets’ estimated useful

lives. Leasehold improvements are carried at cost less accumulated amortization and are

amortized over the lesser of useful life or the remaining fixed non-cancelable lease term.

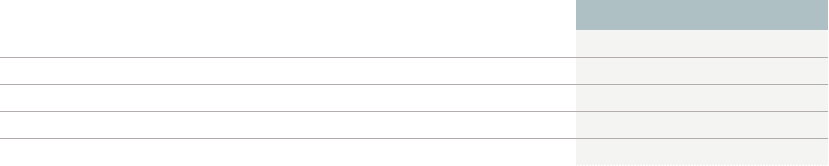

Useful lives for each asset category are estimated as follows:

Useful Life

Buildings 40 years

Equipment, furniture and fixtures 5 to 7 years

Computer equipment 3 years

Computer software 5 years

Capitalized IT projects 5 years