Navy Federal Credit Union 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union36

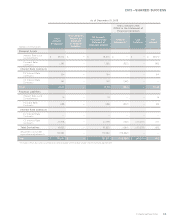

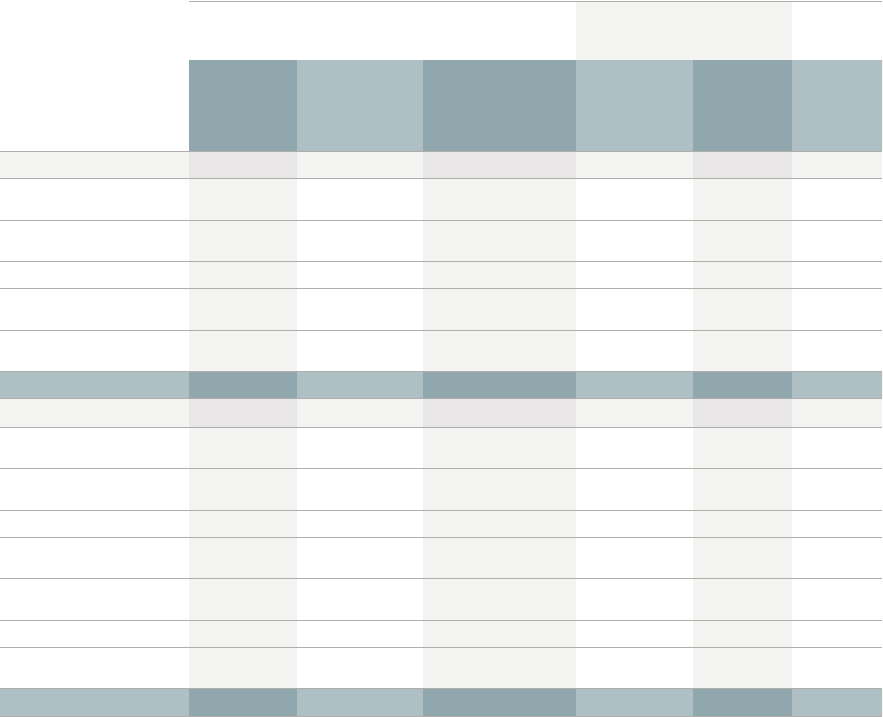

As of December 31, 2014

Gross Amounts Not

Oset in the Statement of

Financial Condition

Gross

Amounts

Recognized

Gross Amounts

Oset in the

Statement

of Financial

Condition

Net Amounts

Presented in the

Statement of

Financial Condition

Financial

Instruments(1)

Cash

Collateral

Net

Amount

(dollars in thousands)

Financial Assets

Interest Rate Lock

Commitments $ 8,771 $ — $ 8,771 $ — $ — $ 8,771

Forward Sales

Contracts 943 — 943 (723) — 220

Interest Rate Contracts

FV Interest Rate

Contracts 361 — 361 — — 361

CF Interest Rate

Contracts 743 — 743 (743) — —

Total 10,818 — 10,818 (1,466) — 9,353

Financial Liabilities

Interest Rate Lock

Commitments 3 — 3 — — 3

Forward Sales

Contracts 3,558 — 3,558 (723) (1,886) 949

Interest Rate Contracts

FV Interest Rate

Contracts — — — — — —

CF Interest Rate

Contracts 34,311 — 34,311 (743) (33,207) 361

Total Derivatives 37,872 — 37,872 (1,466) (35,093) 1,313

Securities sold under

repurchase agreements 1,469,502 — 1,469,502 (1,469,502) — —

Total $ 1,507,374 $ — $ 1,507,374 $ (1,470,968) $ (35,093) $ 1,313

(1)Includes oset by same counterparty where legally enforceable under master netting agreement.

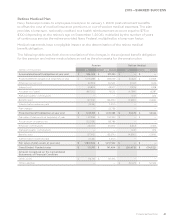

NOTE 11: CONTINGENCIES

Navy Federal is party to various legal and regulatory actions normally associated with financial

institutions, the aggregate eect of which, in the opinions of management and legal counsel,

would not be material to the financial condition or results of operations of Navy Federal.

NOTE 12: COMMITMENTS

In the normal course of business, Navy Federal enters into conditional commitments to extend

credit and makes financial guarantees to help meet the financing needs of its members. Unfunded

loan commitments are amounts Navy Federal has agreed to lend a member generally as long

as the member remains in good standing on existing loans. Commitments generally have fixed

expiration dates or other termination clauses. Navy Federal uses the same credit policies in

making commitments as it does for all loans to members, and accordingly, at December 31, 2015