Navy Federal Credit Union 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Section 41

2015—SHARED SUCCESS

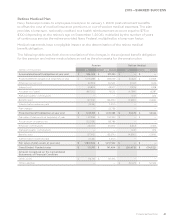

Retiree Medical Plan

Navy Federal provides, to employees hired prior to January 1, 2009, post-retirement benefits

to oset the cost of medical insurance premiums or out-of-pocket medical expenses. The plan

provides a lump sum, notionally credited, to a health reimbursement account equal to $75 or

$100 (depending on the retiree’s age on September 1, 2008), multiplied by the number of years

of continuous service the retiree provided Navy Federal, multiplied by a lump sum factor.

Medical cost trends have a negligible impact on the determination of the retiree medical

benefit obligation.

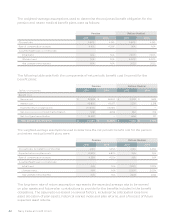

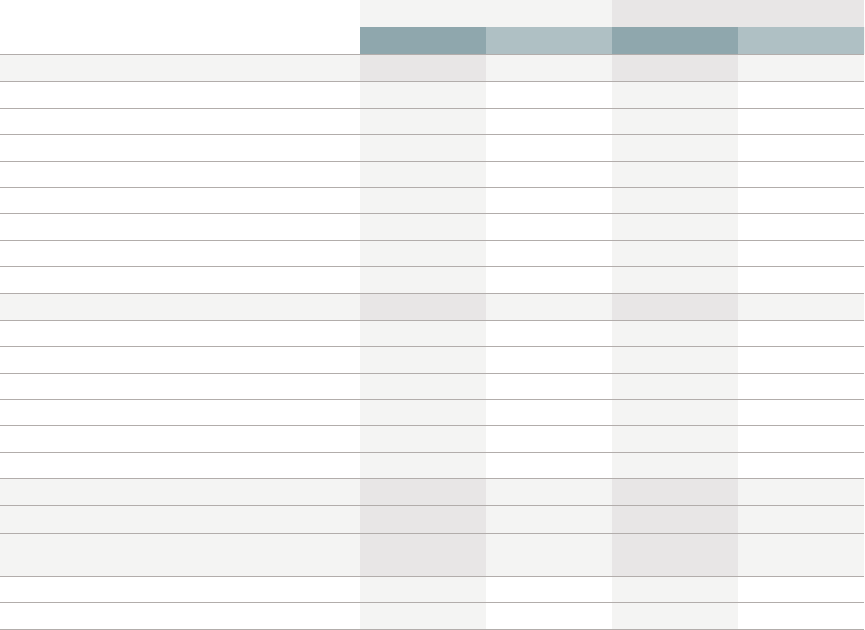

The following table sets forth the reconciliation of the changes in the projected benefit obligation

for the pension and retiree medical plans as well as the plan assets for the pension plan:

Pension Retiree Medical

(dollars in thousands) 2015 2014 2015 2014

Accumulated benefit obligation at year end $ 926,048 $ 971,305 $ — $ —

Projected Benefit obligation at beginning of year $ 1,076,088 $ 856,149 $ 54,522 $ 44,559

Employer service cost 32,593 26,540 2,002 1,623

Interest cost 45,802 43,977 2,276 2,318

Actuarial loss/(gain) (86,720) 161,212 (4,784) 8,387

Plan participants’ contributions — — 1,147 1,251

Benefits paid (37,143) (33,274) (4,690) (3,616)

Administrative expenses paid (1,435) (1,272) — —

Plan changes — 22,756 — —

Projected benefit obligation at year end $ 1,029,185 $ 1,076,088 $ 50,473 $ 54,522

Fair value of plan assets at beginning of year $ 1,217,582 $ 1,141,342 $ — $ —

Actual return on plan assets (23,058) 85,786 — —

Employer contributions 25,000 25,000 3,543 2,365

Plan participants’ contributions — — 1,147 1,251

Benefits paid (37,143) (33,274) (4,690) (3,616)

Administrative expenses paid (1,435) (1,272) — —

Fair value of plan assets at year end $ 1,180,946 $ 1,217,582 $ — $ —

Over/(Under) Funded status $ 151,761 $ 141,494 $ (50,473) $ (54,522)

Amount recognized on the Consolidated

Statements of Financial Condition:

Other Assets $ 151,761 $ 141,494 — —

Other Liabilities — — $ 50,473 $ 54,522