Navy Federal Credit Union 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Section 49

2015—SHARED SUCCESS

Mortgage Servicing Rights

MSRs are carried at fair value on a recurring basis. MSRs do not trade in an active, open market

with readily observable prices. Navy Federal obtains the fair value of its MSRs from a third-

party service organization, which determines fair value by discounting projected net servicing

cash flows of Navy Federal’s servicing portfolio, taking into consideration actual and expected

loan prepayment rate, discount rate, servicing costs and other economic factors. The fair value

of MSRs is primarily aected by changes in mortgage interest rates since rate changes cause

the loan prepayment acceleration factors to increase or decrease. The valuation is based on

unobservable inputs and therefore classified within Level 3 of the fair value hierarchy.

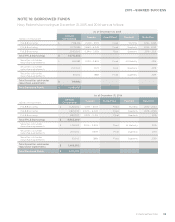

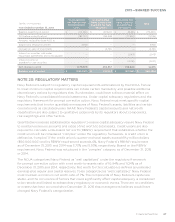

The key economic assumptions used in determining the fair value of MSRs at December 31, 2015

and 2014 were as follows:

2015 2014

Weighted-average life (years) 6.20 5.90

Prepayment rate 11.56% 12.63%

Yield-to-maturity discount rate 9.86% 9.84%

Derivative Assets and Liabilities

Fair values of Navy Federal’s interest rate swaps designated as cash flow and fair value hedges

are determined based on third-party models that calculate the net present value of future cash

flows discounted using the Overnight Indexed Swap (OIS) rate. Counterparty non-performance

risk is considered by discounting future cash flows using OIS rates adjusted for credit quality.

Navy Federal also uses an internal process to further evaluate the risk of counterparty default.

Fair values of Navy Federal’s IRLCs are determined based on an evaluation of best execution

forward contract prices sourced from the TBA market, adjusted by a factor that represents the

probability it will settle and become MLAS. IRLCs are classified as Level 3 in the fair value hierarchy.

Fair values of Navy Federal’s forward sales contracts on TBA securities are determined based on

an evaluation of best execution forward contract prices sourced from the TBA market, by agency.

As such, TBA hedges are classified as Level 2 in the fair value hierarchy.

Mortgage Loans Awaiting Sale

MLAS comprise those loans Navy Federal intends either to sell or to securitize. The initial

loan level basis is equal to unpaid principal balance plus or minus origination costs and fees.

Navy Federal has elected the fair value option for MLAS. The fair value of MLAS is determined

based on an evaluation of best execution forward sales contract prices sourced from the TBA

market, by agency (e.g., GNMA, FHLMC, FNMA). As such, MLAS are classified as Level 2 in the

fair value hierarchy.