Navy Federal Credit Union 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union24

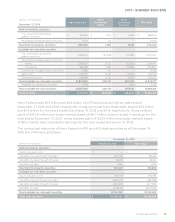

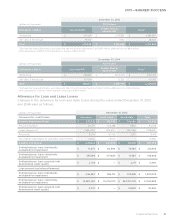

For the year ended December 31, 2015, TDRs that were more than 90 days delinquent within the

first 12 months after modification totaled $123.6 million, which included $60.6 million of consumer

loans, $44.3 million of credit card loans and $18.7 million of real estate loans.

For the year ended December 31, 2014, TDRs that were more than 90 days delinquent within the

first 12 months after modification totaled $92.5 million, which included $35.6 million of consumer

loans, $28.1 million of credit card loans and $28.8 million of real estate loans. The December 31, 2014

amount for TDRs that were more than 90 days delinquent within the first 12 months after

modification has been revised from previously reported amount of $5.8 million to $92.5 million.

The revised amount is not material to financial statements.

At December 31, 2015 and 2014, there were no unfunded commitments related to loans that had

previously been modified as TDRs.

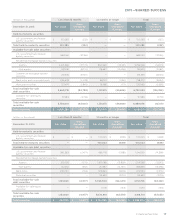

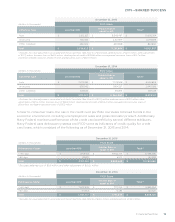

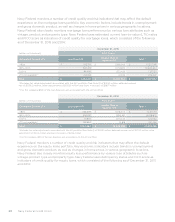

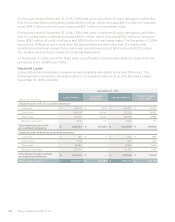

Impaired Loans

Loans defined as individually impaired include business real estate loans and TDR loans. The

following table represents information about our impaired loans as of and for the years ended

December 31, 2015 and 2014:

December 31, 2015

Loan Amount Associated

Allowance Average Balance Interest Income

(cash basis)

(dollars in thousands)

Impaired Loans with an associated allowance

Consumer $ 456,143 $ 71,675 $ 429,397 $ 43,974

Credit card 284,656 62,994 271,226 28,851

Real estate 491,160 76,056 524,193 19,988

Business real estate 5,615 127 3,083 271

Total Impaired Loans with

an associated allowance $ 1,237,574 $ 210,853 $ 1,227,899 $ 93,084

Impaired Loans without an associated allowance

Consumer $ 720 $ — $ 1,282 $ 684

Credit card 1,556 — 1,691 262

Real estate 58,880 — 33,839 2,695

Business real estate 202,244 — 170,575 7,453

Total Impaired Loans without

an associated allowance $ 263,400 $ — $ 207,386 $ 11,094

Total Impaired Loans $ 1,500,973 $ 210,853 $ 1,435,285 $ 104,178