Navy Federal Credit Union 2015 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Section 19

2015—SHARED SUCCESS

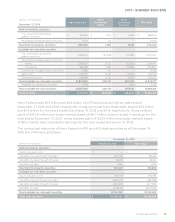

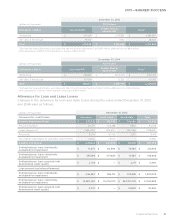

December 31, 2015

(dollars in thousands) FICO Score

Collateral Type Less than 610 Greater than or

equal to 610 Total(1)

Auto $ 2,612,327 $ 8,343,467 $ 10,955,794

Unsecured 790,354 2,307,519 3,097,873

Other Collateral 236,942 630,898 867,840

Total $ 3,639,623 $ 11,281,884 $ 14,921,507

(1)Excludes fair value adjustments associated with the ACI portfolio (See Note 5) of $1.6 million, deferred costs of $21.9 million, other adjustments

of $(7.7) million, business loans of $44.5 million, checking line of credit of $399.8 million, pre-approved consumer loans of $12.7 million,

overdrawn member accounts of $32.7 million and education loans of $321.6 million.

December 31, 2014

(dollars in thousands) FICO Score

Collateral Type Less than 610 Greater than or

equal to 610 Total(1)

Auto $ 2,209,261 $ 7,723,548 $ 9,932,809

Unsecured 676,042 1,964,527 2,640,569

Other Collateral 228,624 576,515 805,139

Total $ 3,113,927 $ 10,264,590 $ 13,378,517

(1)Excludes fair value adjustments associated with the ACI portfolio (See Note 5) of $(1.0) million, deferred costs of $13.0 million, other

adjustments of $(1.6) million, business loans of $38.9 million, checking line of credit of $356.4 million, pre-approved consumer loans of

$11.8 million and federal education loans of $315.3 million.

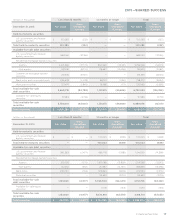

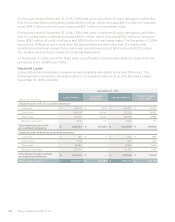

Similar to consumer loans, the risk in the credit card portfolio correlates to broad trends in the

economic environment, including unemployment rates and gross domestic product. Additionally,

Navy Federal monitors performance of the credit card portfolio by several dierent attributes.

Navy Federal uses delinquency status and FICO score as indicators of credit quality for credit

card loans, which consisted of the following as of December 31, 2015 and 2014:

December 31, 2015

(dollars in thousands) FICO Score

Delinquency Status Less than 610 Greater than or

equal to 610 Total(1)

<=60 days $ 1,945,912 $ 8,652,473 $ 10,598,385

>60 days 155,311 6,972 162,283

Total $ 2,101,223 $ 8,659,445 $ 10,760,668

(1)Excludes deferred cost of $0.5 million and other adjustment of $(0.2) million.

December 31, 2014

(dollars in thousands) FICO Score

Delinquency Status Less than 610 Greater than or

equal to 610 Total(1)

<=60 days $ 1,675,335 $ 7,710,159 $ 9,385,494

>60 days 117,442 6,485 123,927

Total $ 1,792,777 $ 7,716,644 $ 9,509,421

(1)Excludes fair value adjustments associated with the ACI portfolio (See Note 5) of $(2.1) million and deferred cost of $0.5 million.