Navy Federal Credit Union 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union30

The liability recognized for estimated losses related to these loss-sharing agreements is included

in Other liabilities in the Consolidated Statements of Financial Condition. In the Consolidated

Statements of Income, the related expense is included as an oset to Net gains on mortgage

loan sales for loans sold during the current period, or in Loan servicing expenses for any re-

measurement of the liability related to loans sold in prior years.

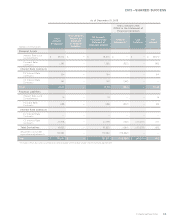

FNMA Loss-Sharing Agreements: Navy Federal sold mortgage loans to FNMA under loss-sharing

agreements from years 2006 to 2008, whereby Navy Federal agreed to indemnify FNMA for

loans having high LTV ratios through the life of the loans and for losses related to other loans,

with higher LTV ratios and no private mortgage insurance, that occur during a period of three

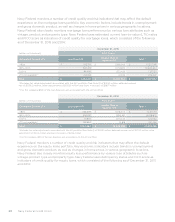

years from the applicable setlement date. The following table summarizes proceeds received for

sales of loans and payments made for losses under these agreements during the years ended

December 31, 2015 and 2014:

FNMA

(dollars in

thousands)

Outstanding UPB of

Loans Sold to FNMA

as of 12/31

Maximum Future

Exposure Under Loss-

Sharing Agreements

Losses Paid to FNMA

during the year ended

12/31

Liability for

Estimated Losses

as of 12/31

2015 $ 525,138 $ 107,586 $ 14,029 $ 27,277

2014 1,330,333 239,852 14,385 26,852

This liability is included in Other liabilities in the Consolidated Statements of Financial Condition.

In the Consolidated Statements of Income, the related expense is included as an oset to Net

gains on mortgage loan sales for loans sold during the current year, or in Loan servicing expenses

for any re-measurement of the liability related to loans sold in prior years.

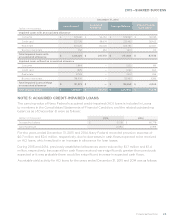

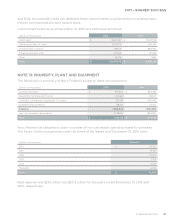

NOTE 7: MORTGAGE SERVICING RIGHTS

The changes in fair value of MSRs during 2015 and 2014 were as follows:

(dollars in thousands) 2015 2014

Balance, beginning of period $ 235,801 $ 236,579

Additions from loans sold with servicing retained 63,099 34,063

Change in fair value due to:

Payos/maturities(1) (32,083) (24,464)

Gain/(loss)(2) 4,059 (10,377)

Balance, end of period $ 270,876 $ 235,801

(1)Represents MSR value changes resulting from passage of time, including the impact from scheduled loan principal payments and loans that

were paid down or paid o during the period.

(2)Represents MSR value changes resulting primarily from market-driven changes in interest rates.

MSRs do not trade in an active, open market with readily observable prices. Navy Federal obtains

the fair value of its MSRs from a third-party service organization, which determines fair value by

discounting projected net servicing cash flows of Navy Federal’s servicing portfolio, taking into

consideration actual and expected loan prepayment rates, discount rate, servicing costs and other

economic factors. The fair value of MSRs is primarily aected by changes in mortgage interest

rates since rate changes cause the loan prepayment acceleration factors to increase or decrease.