Navy Federal Credit Union 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union50

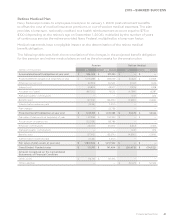

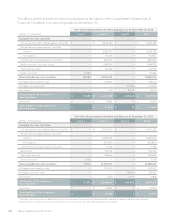

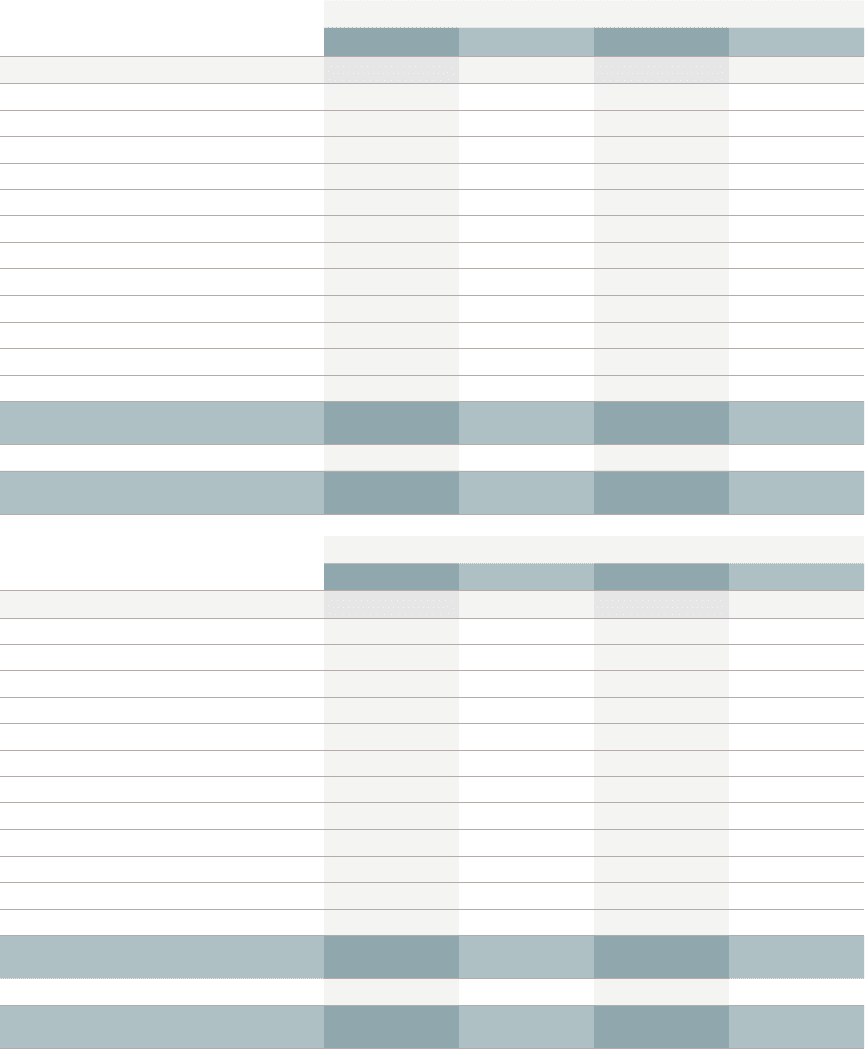

The tables below present the items recognized at fair value in the Consolidated Statements of

Financial Condition on a recurring basis at December 31:

Fair Value Measurements on Recurring Basis as of December 31, 2015

(dollars in thousands) Level 1 Level 2 Level 3 Total

Available-for-sale securities

U.S. government and federal agency securities $ — $ 4,965,482 $ — $ 4,965,482

Residential mortgage-backed securities

Agency — 5,529,755 — 5,529,755

Non-agency — 761,565 — 761,565

Commercial mortgage-backed securities — 285,320 — 285,320

Bank notes and corporate bonds — 1,958,345 — 1,958,345

Municipal securities — 262,166 — 262,166

Equity securities 97,283 — — 97,283

Total available-for-sale securities 97,283 13,762,633 — 13,859,916

Mortgage loans awaiting sale — 708,015 — 708,015

Mortgage servicing rights — — 270,876 270,876

Derivatives — 1,741 18,570 20,311

Total assets at fair value on a

recurring basis $ 97,283 $ 14,472,389 $ 289,446 $ 14,859,118

Derivatives $ — $ 41,606 $ 19 $ 41,625

Total liabilities at fair value on a

recurring basis $ — $ 41,606 $ 19 $ 41,625

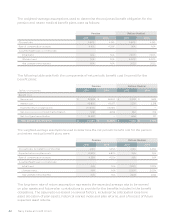

Fair Value Measurements on Recurring Basis as of December 31, 2014

(dollars in thousands) Level 1 Level 2 Level 3 Total

Available-for-sale securities

U.S. government and federal agency securities $ — $ 5,204,237 $ — $ 5,204,237

Residential mortgage-backed securities

Agency — 5,289,946 — 5,289,946

Non-agency — 655,805 — 655,805

Commercial mortgage-backed securities — 14,381 — 14,381

Bank notes — 1,551,156 — 1,551,156

Municipal securities — 259,652 — 259,652

Equity securities 11,015 — — 11,015

Total available-for-sale securities 11,015 12,975,177 — 12,986,192

Mortgage loans awaiting sale — 572,420 — 572,420

Mortgage servicing rights — — 235,801 235,801

Derivatives(1) — 2,047 8,771 10,818

Total assets at fair value on a

recurring basis $ 11,015 $ 13,549,644 $ 244,572 $ 13,805,231

Derivatives $ — $ 37,869 $ 3 $ 37,872

Total liabilities at fair value on a

recurring basis $ — $ 37,869 $ 3 $ 37,872

(1)Includes a reclassification of $8.8 million to the classification of previously disclosed amounts related to interest rate lock commitments

between level 2 and level 3. This misclassification is not material to the consolidated financial statements.