Navy Federal Credit Union 2015 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

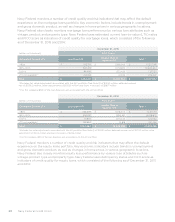

Financial Section 23

2015—SHARED SUCCESS

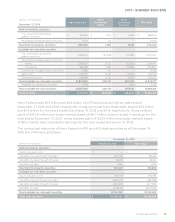

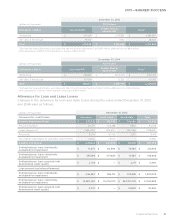

(dollars in thousands) 2015 2014

Consumer $ 136,153 $ 92,977

Credit card 107,866 76,919

Real estate 105,088 134,622

Total $ 349,107 $ 304,518

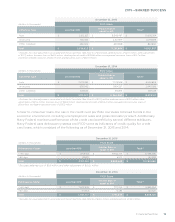

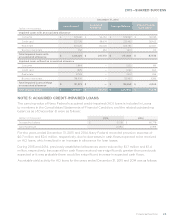

Troubled Debt Restructurings

TDRs are individually evaluated for impairment beginning in the month of restructuring.

Impairment is measured as the dierence between the net carrying amount of the loan (less any

fees received to aect the restructuring) and the modified future expected cash flows discounted

at the loan’s eective interest rate. Loans that have been discharged in Chapter 7 bankruptcy are

classified as TDRs. Non-performing Chapter 7 bankruptcy TDRs are measured for impairment

based on the value of the underlying collateral.

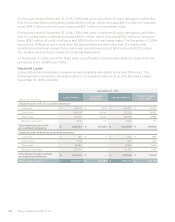

The following tables summarize the financial impact, by concession type, of loans that became

TDRs during the years ended December 31, 2015 and 2014:

Troubled Debt Restructurings During the Year Ended December 31, 2015(1)

(dollars in thousands)

Interest Rate

Reduction & Term

Extension

Interest Rate

Reduction Term Extension Other(2) Total

Consumer $ 4,376 $ 6,465 $ 12,385 $ 2,717 $ 25,944

Credit card — 32,518 — 14 32,532

Real estate 5,327 464 1,539 4,547 11,877

Total $ 9,703 $ 39,447 $ 13,924 $ 7,278 $ 70,353

(1)Excludes loans that were classified as TDRs in prior years and re-modified during the year.

(2)Includes TDR loans resulting from actions taken by a bankruptcy court, such as the reduction of the loan’s contractual principal or interest,

or where the borrower has been released from personal liability, and mortgage deferrals.

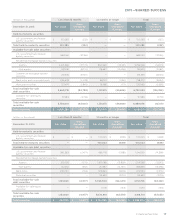

Troubled Debt Restructurings During the Year Ended December 31, 2014(1)

(dollars in thousands)

Interest Rate

Reduction & Term

Extension

Interest Rate

Reduction Term Extension Other(2) Total

Consumer $ 3,806 $ 7,653 $ 9,549 $ 2,490 $ 23,498

Credit card — 31,795 — 1,625 33,420

Real estate 4,503 269 645 6,862 12,279

Total $ 8,309 $ 39,717 $ 10,194 $ 10,977 $ 69,197

(1)Excludes loans that were classified as TDRs in prior years and re-modified during the year.

(2)Includes TDR loans resulting from actions taken by a bankruptcy court, such as the reduction of the loan’s contractual principal or interest,

or where the borrower has been released from personal liability, and mortgage deferrals.

In subsequent periods, income is recognized based on a loan’s modified expected cash flows and

revised eective interest rate. Additional impairment is recognized for TDRs that exhibit further

credit deterioration after modification.