Navy Federal Credit Union 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Section 31

2015—SHARED SUCCESS

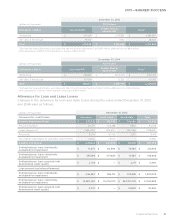

MSR valuation is sensitive to interest rate and prepayment risk. A sensitivity analysis of the

hypothetical eect on the fair value of MSRs to adverse changes in key assumptions is presented

below. Changes in fair value generally cannot be extrapolated because the relationship of the

change in the assumption to the change in fair value may not be linear. Also, the eect of a

variation in a particular assumption on the fair value of the MSRs is calculated independently

without changing any other assumptions. Changes in one assumption may aect changes in

another, which could either magnify or counteract the sensitivities.

The key economic assumptions used in determining the fair value of MSRs and the sensitivity

analysis of the hypothetical eect on the fair value of the MSRs to immediate adverse changes

of 10% and 20% in those assumptions at December 31, 2015 and 2014 were as follows:

(dollars in thousands) 2015 2014

Weighted-average life (years) 6.20 5.90

Weighted-average prepayment rate 11.56% 12.63%

Decline in fair value from 10% adverse change $ 259,618 $ 225,018

Decline in fair value from 20% adverse change 249,121 215,106

Weighted-average discount rate 9.86% 9.84%

Decline in fair value from 10% adverse change $ 261,439 $ 227,608

Decline in fair value from 20% adverse change 252,615 220,034

NOTE 8: REAL ESTATE OWNED

Navy Federal obtains REO through foreclosure proceedings or when a delinquent borrower

chooses to transfer a mortgaged property in lieu of foreclosure. REO represents held-for-sale

assets carried at lower of cost or fair value less costs to sell. Navy Federal generally expects

to dispose of REO held within one year or less, and the holding costs such as insurance,

maintenance, taxes and utility costs are expensed as incurred. REO, which we report in our

Consolidated Statements of Financial Condition under Other assets, totaled $19.1 million and

$18.5 million as of December 31, 2015 and 2014, respectively.

Mortgage loans for which formal foreclosure proceedings were in process amounted to $38.8

million and $43.0 million as of December 31, 2015 and 2014, respectively.

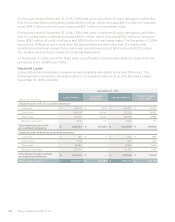

NOTE 9: DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES

Navy Federal’s risk management strategies include the use of derivatives as economic hedges

and derivatives designated as qualifying accounting hedges. The goal of these strategies is to

mitigate market risk so that movements in interest rates do not adversely aect the value of

Navy Federal’s assets or liabilities, or its earnings and future cash flows. Navy Federal executes

derivative contracts over-the-counter and clears these transactions through a derivative clearing

organization (DCO). The following table identifies derivative instruments in a gain position

included in Other assets as well as derivative instruments in a loss position included in Other

liabilities in the Consolidated Statements of Financial Condition at December 31, 2015 and 2014.