Navy Federal Credit Union 2015 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 ANNUAL REPORT 15

INPUT FOR THE 2015 ANNUAL REPORT

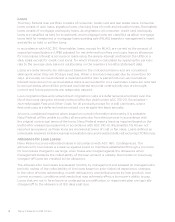

The Supervisory Committee provides the membership with an independent appraisal of the

safety and soundness of Navy Federal’s operations and activities. It does so in compliance with

the Federal Credit Union Act and Navy Federal’s bylaws. The Supervisory Committee ensures

that Navy Federal’s financial statements provide a fair and accurate presentation of its financial

condition and that management establishes and maintains sound internal controls to protect

the assets of your credit union.

The Supervisory Committee employs the independent accounting firm of PricewaterhouseCoopers

LLP (PwC) to assist in meeting its responsibilities. The Committee meets regularly with PwC to

evaluate audit results and to plan future audit work. PwC conducts quarterly procedures related

to selected operations and performs a comprehensive audit of the credit union’s year-end

financial statements. PwC’s year-end audit, the Independent Auditor’s Report, appears in this

Annual Report.

Acting as your ombudsman, the Supervisory Committee assures that all members are treated

fairly by maintaining an open communication with the membership. Throughout the year,

the committee reviews and responds in writing to all letters and emails it receives from the

membership. Both the membership and the management of Navy Federal benefit from this open

communication because your individual concerns are addressed on a personal basis and your

comments help to ensure that Navy Federal maintains the highest level of service to its members.

The National Credit Union Administration (NCUA), the regulatory agency for all federally

chartered credit unions, also performs periodic supervisory examinations. The results of their

2015 examination disclosed that Navy Federal continues to be financially strong and a leader

in the credit union movement. In 2015, a review of certain activities was also performed by the

Consumer Financial Protection Bureau (CFPB). Navy Federal’s asset size places it under the

regulatory supervision of the CFPB for compliance with Federal consumer financial laws.

Based on the results of PwC, NCUA and CFPB, it is the opinion of your Supervisory Committee

that Navy Federal continues to be financially strong and compliant. We can also assure you

that the policies, programs and management practices of your credit union are sound and

eectively maintained, and that both your Supervisory Committee and the management and

sta of Navy Federal will continue to provide world-class service to every member.

Michael C. Wholley

Chairman

SUPERVISORY COMMITTEE