Navy Federal Credit Union 2015 Annual Report Download - page 32

Download and view the complete annual report

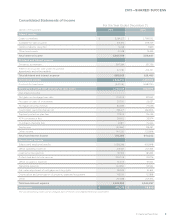

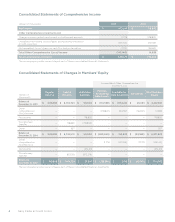

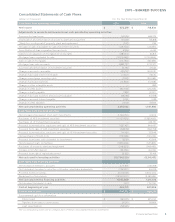

Please find page 32 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Financial Section 13

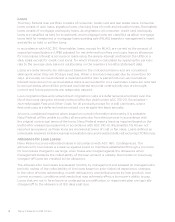

2015—SHARED SUCCESS

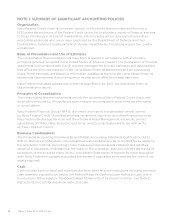

Advertising Costs

Advertising costs are expensed as incurred and are included in the Marketing expense in the

Consolidated Statements of Income.

Income Taxes

Pursuant to the Federal Credit Union Act, Navy Federal is exempt from the payment of federal

and state income taxes. NFFG is a limited liability corporation and thus an entity “disregarded

for federal tax purposes” under an Internal Revenue Service revenue ruling.

Dividends

Dividend rates on members’ accounts are set by Navy Federal’s Board of Directors, and dividends

are charged to expense. Dividends on all share products are paid monthly.

Reclassifications

Certain amounts in the prior year’s financial statements have been reclassified to conform to the

current year presentation.

New Accounting Pronouncements

In February 2016, the FASB issued Accounting Standards Update (ASU) 2016-02, Leases (Topic

842), eective for annual reporting periods beginning after December 15, 2019. Under the new

guidance, a lessee will be required to recognize assets and liabilities for leases with lease terms

of more than 12 months. Consistent with current GAAP, the recognition, measurement and

presentation of expenses and cash flows arising from a lease by a lessee primarily will depend on

its classification as a finance or operating lease. However, unlike current GAAP, which requires

only capital leases to be recognized on the balance sheet, the new ASU will require both types

of leases to be recognized on the balance sheet. The ASU will also require disclosures to help

financial statement users better understand the amount, timing and uncertainty of cash flows

arising from leases. These disclosures include qualitative and quantitative requirements providing

additional information about the amounts recorded in the financial statements. Navy Federal is

currently assessing the impact on its consolidated financial statements.

In January 2016, the FASB issued ASU 2016-01, Financial Instruments-Overall (Subtopic 825-10):

Recognition and Measurement of Financial Assets and Financial Liabilities, eective for annual

reporting periods beginning after December 15, 2018. This ASU requires equity investments

(except those accounted for under the equity method of accounting or those that result in

consolidation of the investee) to be measured at fair value with changes in fair value recognized

in net income. However, an entity may choose to measure equity investments that do not have

readily determinable fair values at cost minus impairment, if any, plus or minus changes resulting

from observable price changes in orderly transactions for the identical or a similar investment

of the same issuer. This ASU is not expected to materially impact Navy Federal’s consolidated

financial statements.

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606),

eective for annual reporting periods beginning after December 15, 2017. In July 2015, ASU 2015-

14 FASB deferred the eective date of ASU 2014-09 for one year. ASU 2014-09 requires an entity

to recognize revenue to depict the transfer of promised goods or services to customers in an

amount that reflects the consideration to which the company expects to be entitled in exchange

for those goods or services. The guidance should be applied either retrospectively to each prior