Navy Federal Credit Union 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union40

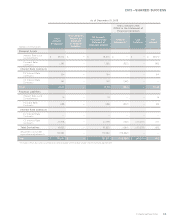

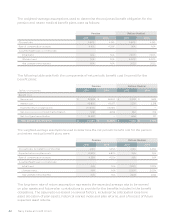

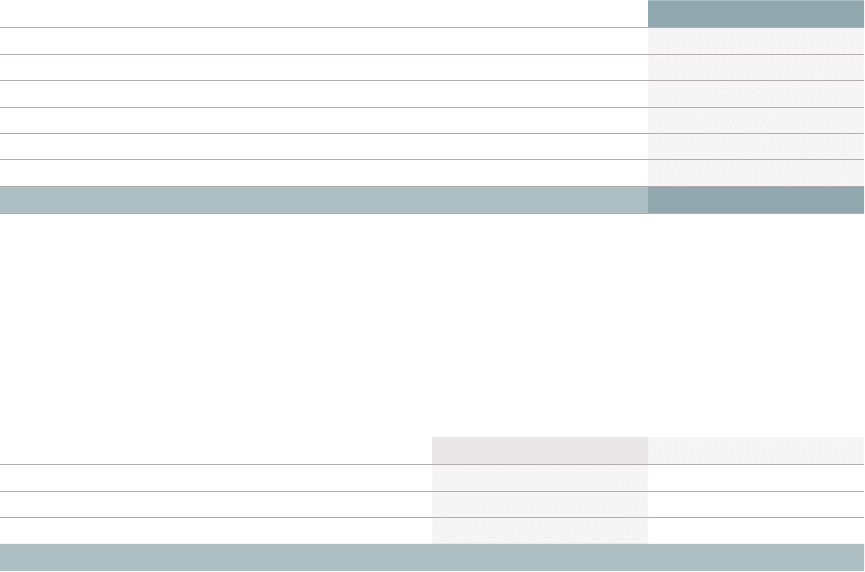

The following table displays the amount of borrowed funds by maturity for each of the next five

years and thereafter as of December 31, 2015:

(dollars in thousands) Amount

2016 $ 6,504,398

2017 2,108,500

2018 1,971,700

2019 1,198,800

2020 964,439

Thereafter 2,745,000

Total $ 15,492,837

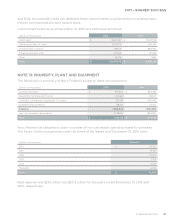

At December 31, 2015, Navy Federal had $17.6 billion pledged as collateral for FHLB borrowings,

which comprised $0.01 billion in investments and $17.61 billion in mortgage loans held for

investment. At December 31, 2014, Navy Federal had $14.03 billion pledged as collateral for FHLB

borrowings, which comprised $0.01 billion in investments and $14.02 billion in mortgage loans

held for investment.

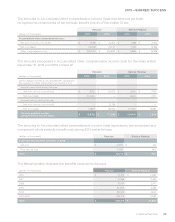

Navy Federal had the following unused lines of credit as of December 31:

(dollars in thousands) 2015 2014

Federal Reserve Bank $ 15,027,866 $ 5,166,028

FHLB 2,843,749 4,089,873

Fed Funds 272,500 272,500

Total $ 18,144,115 $ 9,528,401

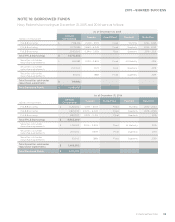

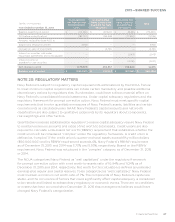

NOTE 17: RETIREMENT BENEFIT PLANS

Navy Federal Credit Union Employees’ Retirement Plan

Navy Federal’s Employees’ Retirement Plan is a defined benefit retirement plan with benefits

based on set formulas. Navy Federal transitioned to a Cash Balance design as of January 1, 2001,

but retained the Traditional design for those employees who opted to remain under the

Traditional formula. The following describes how the benefits are calculated:

Cash Balance—This design provides either a single sum payment upon retirement or a monthly

annuity. The annuity option is available for each Cash Balance Plan participant who has a benefit

value of more than $5,000.

Traditional—This structure is designed to provide a lifetime of monthly retirement benefits,

determined by a set formula. The formula is based on the final average earnings (an average

of the three highest consecutive years of income) multiplied by 2%, times the length of

employee service.