Navy Federal Credit Union 2015 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 ANNUAL REPORT 5

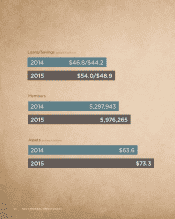

SUPERIOR SERVICE LEADS TO MORE LOANS

Our top-notch service and continued low interest rates resulted in record growth in Navy Federal’s

consumer lending originations for a fourth consecutive year. Members took out more than

800,000 loans for $12.5 billion.

Consumer Loans

In 2015, U.S. car sales reached the highest level since 2000. Navy Federal helped by delivering

low rates, fast approvals and great service, as Shavonya shared on Twitter: “@NavyFederal…Best

Customer Service on the planet…#newcarloan.”

We provided more than 325,000 car and truck loans, totaling $6.6 billion. Of the total auto

loans made, 58 percent were for used cars. In August, we began oering a new overseas Auto

Buying Program to help members living outside the U.S. purchase autos at special pre-negotiated

military pricing. This new program generated 342 loans, totaling $9.5 million.

Our entire consumer loan portfolio, including auto, boat, motorcycle and

personal loans, grew by 11.4 percent to $15.6 billion.

Credit Cards

Recognized for great rewards programs and excellent value, Navy Federal’s

credit cards performed exceedingly well again in 2015. Our credit card

portfolio ended the year with 373,000 new accounts and $14.8 billion in

overall sales volume, an increase of $1.7 billion. Part of this growth can be

attributed to our enhanced GO REWARDS® card. Cardholders now receive

three times the points on restaurant purchases, two times the points on

gas and one point for all other purchases. We also eliminated foreign

transaction fees from all of our credit cards and continued our transition

to chip-enabled cards, which provides an extra layer of security in addition

to our Zero Liability policy. By the end of 2015, half of our cardholders

received chip-enabled cards.

2015 In Review

REPORT OF THE CHAIRMAN & PRESIDENT

These new changes

were important to our

members, as Vince D.

shared on Facebook.

“I’ve been using my

cashRewards card on

international trips because

your fee was low and

the rewards were high

enough to compensate.

Now, I don’t have to pay

fees, so that’s more rewards

in my pocket. And with

the EMV chip, it’s my

preferred travel card now.”