Navy Federal Credit Union 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union32

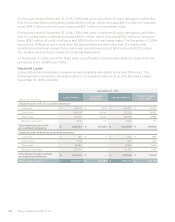

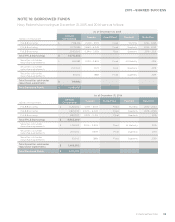

December 31, 2015 December 31, 2014

Notional or

Contractual

Amount

Derivatives at Fair Value Notional or

Contractual

Amount

Derivatives at Fair Value

(dollars in thousands) Asset Liability Asset Liability

Derivatives not designated as accounting hedges:

Interest rate lock

commitments $ 924,445 $ 18,570 $ 19 $ 373,468 $ 8,771 $ 3

Forward sales contracts 1,321,000 1,385 688 753,000 943 3,558

Total derivatives

not designated as

accounting hedges

$ 2,245,445 $ 19,955 $ 707 $ 1,126,468 $ 9,714 $ 3,561

Derivatives designated as accounting hedges:

Interest rate contracts:

Fair value interest rate

contracts $ 10,000 $ 194 $ — $ 10,000 $ 361 $ —

Cash flow interest rate

contracts 950,000 162 40,918 850,000 743 34,311

Total derivatives

designated as

accounting hedges

$ 960,000 $ 356 $ 40,918 $ 860,000 $ 1,104 $ 34,311

Total derivatives $ 3,205,445 $ 20,311 $ 41,625 $ 1,986,468 $ 10,818 $ 37,872

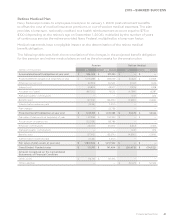

The forward sales contracts in the table above settle within a three-month period, and their note

rates range between 2% and 4%. Management has the intent and ability to fill the incremental

amount of forward sales contracts in excess of open IRLCs. Navy Federal had $708.0 million and

$572.4 million as of December 31, 2015 and 2014, respectively, of mortgage loans classified as

MLAS in the Consolidated Statements of Financial Condition to meet these commitments.

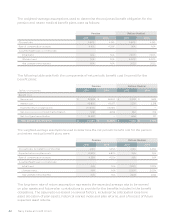

Derivatives Accounted For as Economic Hedges

Navy Federal is an active participant in the production of mortgage loans that are sold to

investors in the secondary market. These loans are classified as MLAS in Navy Federal’s

Consolidated Statements of Financial Condition. The value of Navy Federal’s IRLCs is exposed

to the risk of adverse changes in interest rates between the time of commitment and the time

Navy Federal funds the loan at origination. Navy Federal is also exposed to the risk of adverse

changes in value after funding the loan up until the time when the loan is delivered to the investor.

To oset this exposure, Navy Federal enters into forward sales contracts to deliver mortgage

loans to investors at specified prices in the “To Be Announced” market (TBA securities). These

forward sales contracts act as an economic hedge against the risk of changes in the value of

both the IRLCs and the funded loans. Navy Federal does not account for these derivatives as

qualifying accounting hedges and therefore accounts for them as economic hedges. As required

by ASC 815, Derivatives and Hedging, Navy Federal records IRLCs and forward sales contracts

as derivative instruments at fair value in its Consolidated Statements of Financial Condition and

records changes in the fair value of those derivative instruments in current earnings.

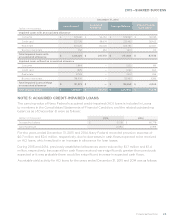

The table below presents gains (losses) on these derivatives for 2015 and 2014. These gains

(losses) are largely oset by the income or expense that is recorded on the IRLCs and funded

loans in Net gains on mortgage loan sales in the Consolidated Statements of Income.