Navy Federal Credit Union 2015 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Financial Section 7

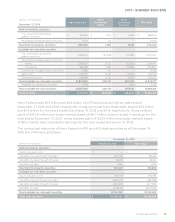

2015—SHARED SUCCESS

Short-Term Investments

Short-term investments include federal funds sold and securities purchased under agreements to

resell, all of which have original maturities of 90 days or less. Short-term investments also include

cash held at Federal Reserve Bank in excess of the minimum reserves. As of December 31, 2015

and 2014, all short-term investments were carried at cost, which approximated fair value.

Investments

Navy Federal’s securities are classified as held-to-maturity (HTM) or available-for-sale (AFS) in

accordance with ASC 320-10, Investments—Debt and Equity Securities. Securities classified as

HTM are carried at cost, adjusted for the amortization of premiums and accretion of discounts.

Management has the ability and intent to hold these securities to maturity. Securities classified

as AFS are carried at fair value, with any unrealized gains and losses recorded as accumulated

other comprehensive income (AOCI), which is a separate component of members’ equity. See

Note 3: Investments for details. Gains and losses on dispositions are computed using the specific

identification method and are included in Net gains on sales of investments in the Consolidated

Statements of Income. For both HTM and AFS securities, interest income is recognized on an

accrual basis, and premiums and discounts are amortized or accreted as an adjustment to interest

income using the interest method (eective yield).

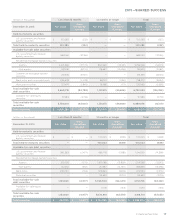

Navy Federal evaluates its securities in an unrealized loss position for other-than-temporary

impairment (OTTI) in accordance with ASC 320-10, Investments—Debt and Equity Securities. A

security is considered impaired when its fair value is less than its amortized cost basis. In order

to determine whether an OTTI exists for its securities in an unrealized loss position, Navy Federal

assesses whether it (a) has the intent to sell the security, (b) is a debt security, where it is more

likely than not that it will be required to sell the security before recovering its amortized cost basis,

or (c) does not expect to recover the entire amortized cost basis of the security even if it does

not intend to sell the security. In order to determine whether the entire amortized cost basis of

the security can be recovered (condition (c) above), Navy Federal compares the present value of

cash flows expected to be collected from the security with its amortized cost basis and considers

(1) the length of time and the extent to which the fair value has been less than cost, (2) adverse

conditions specifically related to the security or specific industry, (3) the volatility of the security

and its expected cash flows, and (4) changes in ratings of the issuer. Declines in fair value deemed

OTTI-attributable to credit quality are recognized in earnings, and declines in fair value related to

other factors are recognized in AOCI.

In accordance with ASC 860-10, Transfers and Servicing, repurchase agreements and reverse

repurchase agreements are recorded at historical cost and accounted for as secured financings

or investments. Navy Federal transfers title to the collateral sold or purchased under repurchase

(reverse repurchase) agreements and monitors the fair value of the underlying securities, which

are primarily U.S. government and federal agency securities. Some of Navy Federal’s repurchase

agreements and reverse repurchase agreements are subject to legally enforceable master netting

agreements, which allow Navy Federal to settle positive and negative positions held with the

same counterparty on a net basis. See Note 10: Balance Sheet Osetting for details.