Navy Federal Credit Union 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Section 53

2015—SHARED SUCCESS

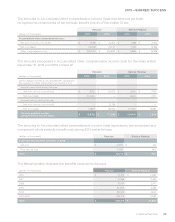

Financial Instruments Accounted For Under Fair Value Option:

Mortgage Loans Awaiting Sale (MLAS)

Fair value and aggregate unpaid principal balance for MLAS are as follows:

Fair Value Unpaid Principal

Balance Dierence

(dollars in thousands)

December 31, 2015

MLAS $ 708,015 $ 692,368 $ 15,647

December 31, 2014

MLAS $ 572,420 $ 553,363 $ 19,057

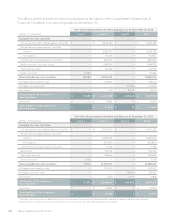

Additional Fair Value Information Related to Other Financial Instruments:

Cash

The reported carrying amount of Cash approximates fair value for vault cash and demand

balances from other financial institutions.

Investments, Including Mortgage-Backed Securities

Fair value is based on quoted market prices, if available. If a quoted market price is not available,

fair value is estimated using quoted market prices for similar securities.

Loans to Members

For residential mortgages, fair value is estimated using the quoted market prices for securities

backed by similar loans. The fair value of other loan types, including consumer and equity loans, is

estimated by discounting expected principal and interest cash flows (net of defaults) using market

rates and adjustments related to non-interest income and expense. Loans that are individually

impaired are carried at the lower of cost or fair value of the underlying collateral, less estimated

cost to sell.

Members’ Accounts

For members’ accounts, the fair value is estimated by discounting expected future cash flows

using market rates. For accounts with no defined maturity, such as Savings, Money Market

Savings, Checking and IRA share accounts, a final maturity of ten years is assumed.

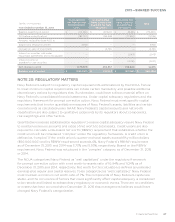

Derivative Instruments and Hedging Activities

Fair values of Navy Federal’s IRLCs are determined based on an evaluation of best execution

forward contract prices sourced from the TBA market. The fair value of forward sales contracts

on MLAS that Navy Federal intends to sell is based on the quoted market price of contracts with

similar characteristics. It is the established practice of Navy Federal to only purchase forward

contracts to cover mortgage loans in process, which are anticipated to close for delivery into

these forward contracts. Accordingly, the cost to terminate existing contracts, which is based on

current market prices, is not material to Navy Federal.

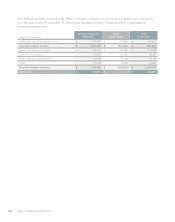

Navy Federal uses pay-fixed interest rate swaps to protect certain fixed-rate investments against

the adverse changes in fair value attributable to changes in interest rates, as well as to hedge the

variability in cash flows related to existing and anticipated replacement funding for floating rate

liabilities that reprice based on LIBOR.