Xerox 2004 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

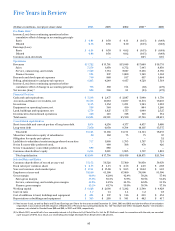

85

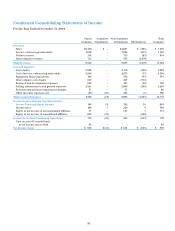

Condensed Consolidating Statements of Income

For the Year Ended December 31, 2003

Parent Guarantor Non-Guarantor Total

Company Subsidiaries Subsidiaries Eliminations Company

Revenues

Sales $3,326 $ — $3,704 $ (60) $ 6,970

Service, outsourcing and rentals 4,257 — 3,680 (203) 7,734

Finance income 337 – 750 (90) 997

Intercompany revenues 535 – 427 (962) —

Total Revenues 8,455 — 8,561 (1,315) 15,701

Cost and Expenses

Cost of sales 2,155 — 2,487 (206) 4,436

Cost of service, outsourcing and rentals 2,314 — 2,019 (22) 4,311

Equipment financing interest 88 – 364 (90) 362

Intercompany cost of sales 473 – 342 (815) —

Research and development expenses 765 — 116 (13) 868

Selling, administrative and general expenses 2,485 — 1,955 (191) 4,249

Restructuring and asset impairment charges 105 – 71 — 176

Gain on affiliate’ssale of stock (13) – — — (13)

Other expenses (income), net 517 (18) 371 6 876

Total Cost and Expenses 8,889 (18) 7,725 (1,331) 15,265

(Loss) Income before Income Taxes (Benefits)

and Equity Income (434) 18 836 16 436

Income taxes (benefits) (108) 7 224 11 134

Equity in net income of unconsolidated affiliates — — 61 (3) 58

Equity in net income of consolidated affiliates 686 (28) — (658) —

Net Income (Loss) $ 360 $ (17) $ 673 $ (656) $ 360