Xerox 2004 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

They want our help in reducing costs,

improving productivity, growing revenue and

creating value for their customers.

That’s exactly what we’re helping them do.

In more and more accounts, large and small,

we are becoming strategic partners. The copier

and hardware company has morphed into a

technology and services enterprise.

Four years ago we made a series of critical

strategic decisions on where to invest. We used

three simple but profound criteria – areas of

our market that were growing the fastest, areas

where our customers were telling us they

needed help and areas where wealready had

core competencies on which we could build.

We let go of businesses where we couldn’t

make money in the short term, or articulate

acredible plan to make money in the long term.

That freed up resources for investment in three

critical areas of the document market – the digital

office, digital production and value-added services.

That’s where we placed our strategic bets.

We’re glad we did. Last year, three-quarters

of our revenue came from these businesses

and revenues from these areas grew 6 percent.

For the first time in five years, growth in our

strategic areas of focus, including the effects

of favorable currency, offset declines in older

technology and other non-strategic businesses.

Now, we are positioned for growth in 2005

and beyond. Here’s why.

Leading The Digital Revolution in the Office

In the digital office,we’re concentrating our

investments on the key growth areas of color,

digital multifunction and office services. We

continue to expand our portfolio of products at

price points that are highly competitive. As a

result, we are participating in more and more

buying decisions.

One way we create value for our office

customers is through our Office Document

AssessmentSM. A recent industry report indicates

that two-thirds of all businesses have initiatives

in place that are aimed at reducing the cost

of document management. You might think

that’s a threat to us; we see it as an opportunity.

Until recently, the costs of documents

flew under the radar screens of most Chief

Information Officers. Once digital technology

put documents on the network, that dramatically

changed the way document management is

viewed. With the help of Xerox, more and more

CIOs are recognizing that they can simultane-

ously reduce costs and improve workflows.

Using XeroxLean Six Sigma methodology,

we analyze in detail all of the document-

intensive processes our customers use to run

their businesses. We identify the exact costs

of the way our customers manage printing,

copying, faxing and scanning functions. Perhaps

even more importantly, we analyze the way

real people work with real documents in the

real world.

We estimate that a typical business spends

up to 5 percent of its revenue on documents.

We can save 20to 40 percent of that while

improving productivity, speed and worker

satisfaction. The opportunity for Xerox is

substantial and weare being very aggressive

about seizing it.

They want our help in reducing costs, improv-

ing productivity, growing revenue and creating

value for their customers.

That’s exactly what we’re helping them do.

In more and more accounts, large and small,

we are becoming strategic partners. The copier

and hardware company has morphed into a

technology and services enterprise.

Four years ago, we made a series of critical

strategic decisions on where to invest. We used

three simple but profound criteria – areas of

our market that were growing the fastest, areas

where our customers were telling us they

needed help and areas where wealready had

core competencies on which we could build.

We let go of businesses where we couldn’t

make money in the short term, or articulate

acredible plan to make money in the long term.

That freed up resources for investment in three

critical areas of the document market – the digital

office, digital production and value-added services.

That’s where we placed our strategic bets.

We’re glad we did. Last year, three-quarters

of our revenue came from these businesses

and revenues from these areas grew 6 percent.

For the first time in five years, growth in our

strategic areas of focus, including the effects

of favorable currency, offset declines in older

technology and other non-strategic businesses.

Now, we are positioned for growth in 2005

and beyond. Here’s why.

Leading The Digital Revolution in the Office

In the digital office,we’re concentrating our

investments on the key growth areas of color,

digital multifunction and office services. We

continue to expand our portfolio of products at

price points that are highly competitive. As a

result, we are participating in more and more

buying decisions.

One way we create value for our office

customers is through our Office Document

AssessmentSM. A recent industry report indicates

that two-thirds of all businesses have initiatives

in place that are aimed at reducing the cost

of document management. You might think

that’s a threat to us; we see it as an opportunity.

Until recently, the costs of documents

flew under the radar screens of most Chief

Information Officers. Once digital technology

put documents on the network, that dramatically

changed the way document management is

viewed. With the help of Xerox, more and more

CIOs are recognizing that they can simultane-

ously reduce costs and improve workflows.

Using XeroxLean Six Sigma methodology,

we analyze in detail all of the document-

intensive processes our customers use to run

their businesses. We identify the exact costs

of the way our customers manage printing,

copying, faxing and scanning functions. Perhaps

even more importantly, we analyze the way

real people work with real documents in the

real world.

We estimate that a typical business spends

up to 5 percent of its revenue on documents.

We can save 20to 40 percent of that while

improving productivity, speed and worker

satisfaction. The opportunity for Xerox is

substantial and weare being very aggressive

about seizing it.

2

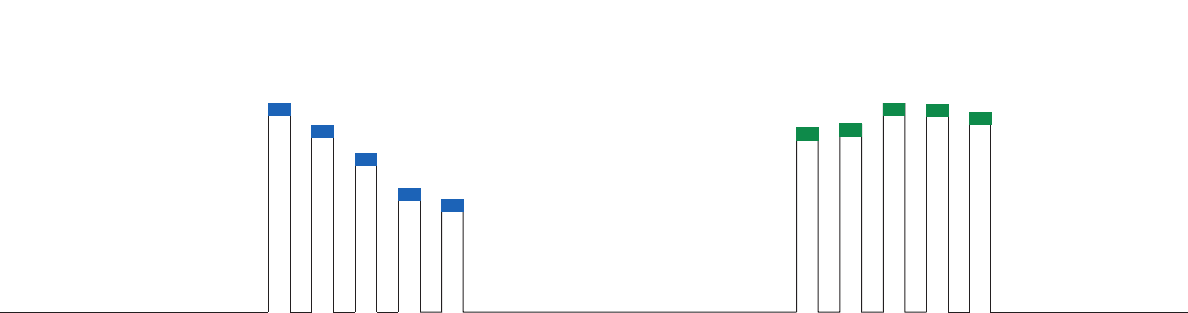

’00’02 ’03 ’04’01 ’00’02 ’03 ’04’01

16.7

14.2

11.2 10.1

18.6

Declining Debt

as of December 31

($ billions)

42.4 42.0 40.6

37.4 38.2

Stabilized

Gross Margins

(Percent)