Xerox 2004 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2004 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

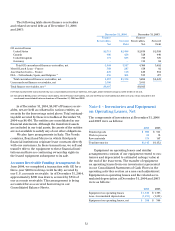

The following table shows finance receivables

and related secured debt as of December 31, 2004

and 2003:

December 31, 2004 December 31, 2003

Finance Finance

Receivables, Secured Receivables, Secured

Net Debt Net Debt

GE secured loans:

United States $2,711 $2,486 $2,939 $2,598

Canada 486 426 528 440

United Kingdom 771 685 719 570

Germany — — 114 84

Total GE encumbered finance receivables, net 3,968 3,597 4,300 3,692

Merrill Lynch Loan – France 368 287 138 92

Asset-backed notes – France 225 148 429 364

DLL – Netherlands, Spain, and Belgium (1) 436 404 335 277

Total encumbered finance receivables, net 4,997 $4,436 5,202 $4,425

Unencumbered finance receivables, net 3,500 3,611

Total finance receivables, net (2) $8,497 $8,813

(1)These represent the loans received by our consolidated joint venture with DLL. De Lage Landen Ireland Company is the lender of record.

(2) Includes (i) Billed portion of finance receivables, net (ii) Finance receivables, net and (iii) Finance receivables due after one year,net as included in the

condensed consolidated balance sheets as of December 31, 2004 and 2003.

As of December 31, 2004, $4,997 of Finance receiv-

ables, net are held as collateral in various entities, as

security for the borrowings noted above. Total outstand-

ing debt secured by these receivables at December 31,

2004 was $4,436. The entities are consolidated in our

financial statements. Although the transferred assets

are included in our total assets, the assets of the entities

are not available to satisfy any of our other obligations.

We also have arrangements in Italy, The Nordic

countries, Brazil and Mexico in which third party

financial institutions originate lease contracts directly

with our customers. In these transactions, wesell and

transfer title to the equipment to these financial insti-

tutions and haveno continuing ownership rights in

the leased equipment subsequent to its sale.

Accounts Receivable Funding Arrangement: In

June 2004, wecompleted a transaction with GEfor a

three-year $400 revolving credit facility secured by

our U.S.accounts receivable. As of December 31, 2004,

approximately $200 was drawn, secured by$354 of

our accounts receivable. This arrangement is being

accounted for as a secured borrowing in our

Consolidated Balance Sheets.

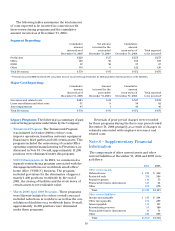

Note 4 – Inventories and Equipment

on Operating Leases, Net

The components of inventories at December 31, 2004

and 2003 were as follows:

20042003

Finished goods $900 $911

Work in process 69 74

Raw materials 174 167

Total inventories $1,143 $1,152

Equipment on operating leases and similar

arrangements consists of our equipment rented to cus-

tomers and depreciated to estimated salvage value at

the end of the lease term. The transfer of equipment

on operating leases from our inventories is presented

in our Consolidated Statements of Cash Flowsin the

operating activities section as a non-cash adjustment.

Equipment on operating leases and the related accu-

mulated depreciation at December 31, 2004and 2003

were as follows:

20042003

Equipment on operating leases $ 1,649 $ 1,795

Less: Accumulated depreciation (1,251) (1,431)

Equipment on operating leases, net $ 398 $364